Your When is tax filing deadline 2021 canada images are ready. When is tax filing deadline 2021 canada are a topic that is being searched for and liked by netizens now. You can Find and Download the When is tax filing deadline 2021 canada files here. Find and Download all royalty-free photos and vectors.

If you’re searching for when is tax filing deadline 2021 canada images information related to the when is tax filing deadline 2021 canada topic, you have come to the ideal site. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that fit your interests.

When Is Tax Filing Deadline 2021 Canada. Tax filing deadline changed for 2022. If you have missed the December 31 deadline of filing your ITR you can still do so. The deadline for paying any taxes owed has shifted from April 30th to August 31st on all personal tax returns. Tax day for individuals extended to may 17 canada revenue agency.

Federal Income Tax Deadline In 2022 Smartasset From smartasset.com

Federal Income Tax Deadline In 2022 Smartasset From smartasset.com

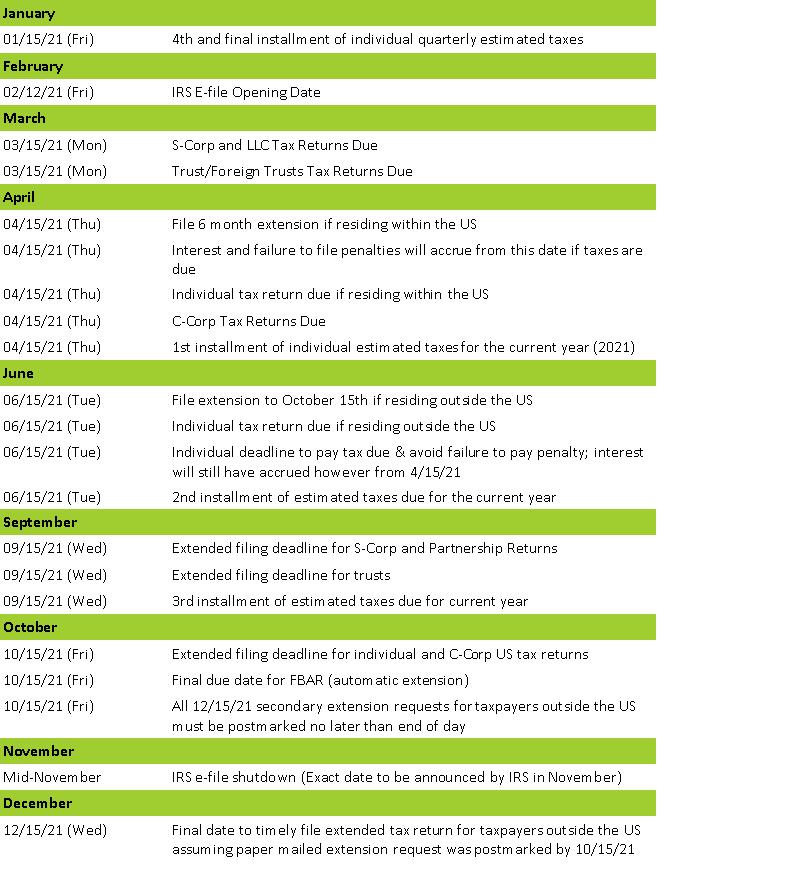

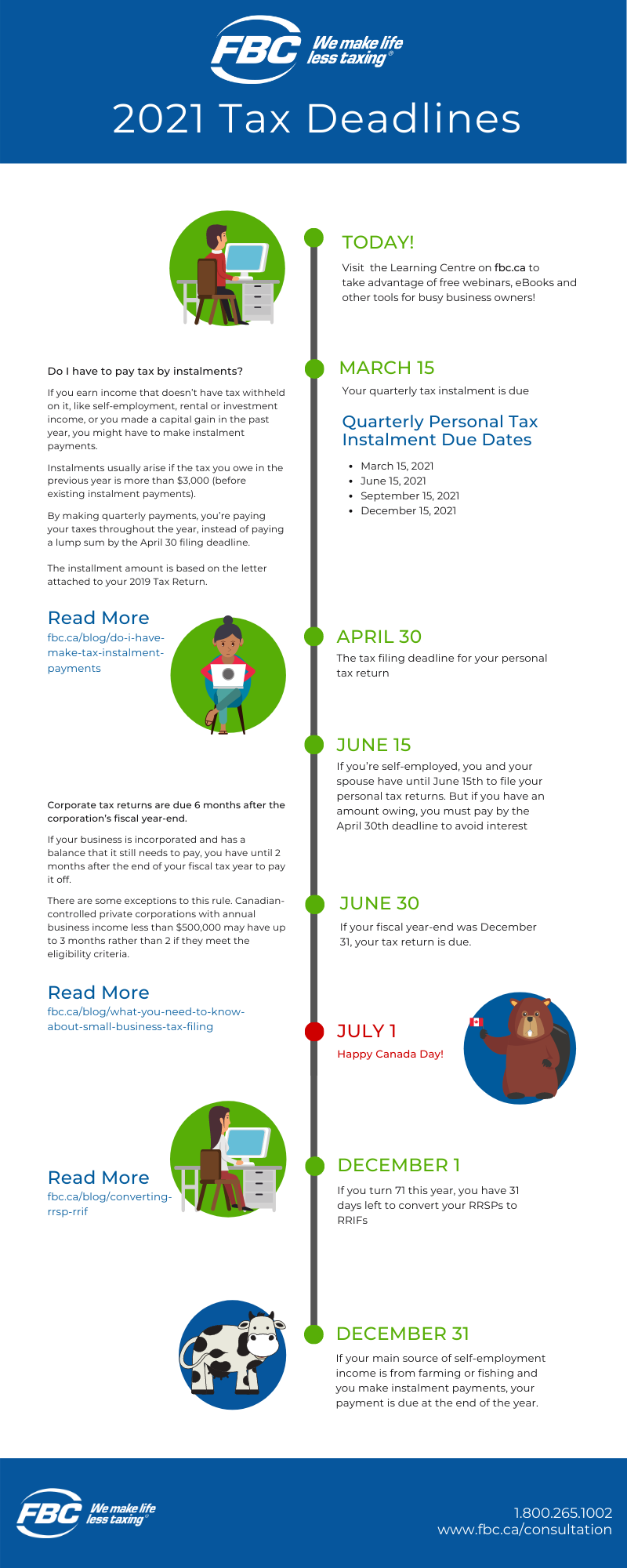

If you sent the CRA Form NR6 and the CRA approved it for 2020 you have to file your section 216 return for 2020 by June 30 2021. No April 15th. The deadline for paying any taxes owed has shifted from April 30th to August 31st on all personal tax returns. For incorporated businesses that. However the deadline is now 2022 across Canada and the United States in the United Statesand Canada. Now that the deadline 31 December 2021 for the filing of FY 2020-21 Income Tax Return ITR is over those who failed to file their tax return must be wondering about the next thing they should do.

The tax-filing deadline for most Canadians for the 2021 tax year is on May 2 2022.

In case of balance owing for 2020 it still has to be paid before 30 April 2021. The due dates for corporate returns are typically six months after the lapse of the fiscal year-end. The 2021 tax filing season kicked off on February 22nd 2021 and Canadian taxpayers are expected to file their tax returns by April 30th 2021. The due date for tax return if your financial year-end was December 31. Even though the ITR filing deadline was extended twice for the financial year many were not able to complete the exercise on time due to many glitches on the newly launched e-filing portal. Tax deadline in 2021 In 2021 it appears the CRA will stick to the usual deadline.

Source: smartasset.com

Source: smartasset.com

In case of balance owing for 2020 it still has to be paid before 30 April 2021. If you do submit a paper return it may take 10-12 weeks for the CRA to issue you your assessment due to. 30 April 2021. However the deadline is now 2022 across Canada and the United States in the United Statesand Canada. Tax Filing Deadlines and Important Dates 2022.

Source: rsm.global

Source: rsm.global

However the deadline is now 2022 across Canada and the United States in the United Statesand Canada. Filing deadline for certain flow-through entities and trusts includes partnerships S corporations foreign grantor trusts and certain other entities and taxpayers. Apr 30 2021. Deadline to file your taxes if you or your spouse or common-law partner are self-employed Payment date for 2020 taxes. For small businesses the filing deadline remains as June 15th unchanged.

Source: myexpattaxes.com

Source: myexpattaxes.com

Tax filing due date for 2020 tax returns in Canada for self-employed and if there is a balance owing for 2020 still must be paid before 30 April 2021. Section 2164 and Section 2165 - Non-residents with Canadian rental income Deadlines. If you are a self-employed individual or if your spouse or common-law partner is self-employed you have until June 15 2021 to. June 15 2021 is the deadline for self-employed individuals to file their 2020 income tax and benefit return. The due date for tax return if your financial year-end was December 31.

Source: moneycontrol.com

Source: moneycontrol.com

If you are a self-employed individual or if your spouse or common-law partner is self-employed you have until June 15 2021 to. 15 June 2021 Filing due date for 2020 tax returns for self-employed in Canada. Filing deadline for certain flow-through entities and trusts includes partnerships S corporations foreign grantor trusts and certain other entities and taxpayers. Deadline to make charitable donations to be claimed for the 2021 tax year. For incorporated businesses that.

Source: brighttax.com

Source: brighttax.com

The deadline for paying any taxes owed has shifted from April 30th to August 31st on all personal tax returns. Last day to settle trades in calendar year 2021 for Canadian tax-loss selling. Tax filing due date for 2020 tax returns for individuals and pay any balance due to the Canada Revenue Agency. Youll need form 4868 to do so and you can also file electronically for an automatic. The deadline is on.

Deadline to make charitable donations to be claimed for the 2021 tax year. Now that the deadline 31 December 2021 for the filing of FY 2020-21 Income Tax Return ITR is over those who failed to file their tax return must be wondering about the next thing they should do. The deadline for paying any taxes owed has shifted from April 30th to August 31st on all personal tax returns. 30 April 2021. Incase you too are one among the above lot you must not worry.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

Tax filing due date for 2020 tax returns in Canada for self-employed and if there is a balance owing for 2020 still must be paid before 30 April 2021. Barring a government announcement the majority of Canadians will have to meet their tax-filing obligations by April 30. Incase you too are one among the above lot you must not worry. For incorporated businesses that. The 2021 tax filing season kicked off on February 22nd 2021 and Canadian taxpayers are expected to file their tax returns by April 30th 2021.

Source: pinterest.com

Source: pinterest.com

The 2021 tax filing season kicked off on February 22nd 2021 and Canadian taxpayers are expected to file their tax returns by April 30th 2021. The tax deadline for 2022 has changed. Tax deadline in 2021 In 2021 it appears the CRA will stick to the usual deadline. Canadas 2021 tax deadline is still April 30. No April 15th.

Source: ndtv.com

Source: ndtv.com

The due date for tax return if your financial year-end was December 31. Tax filing due date for 2020 tax returns for individuals and pay any balance due to the Canada Revenue Agency. Tax deadline in 2021 In 2021 it appears the CRA will stick to the usual deadline. For small businesses the filing deadline remains as June 15th unchanged. No interest will be accumulated on taxes during this period.

Source: co.pinterest.com

Source: co.pinterest.com

The 15th of April is typically the due date to file taxes for tax purposes for the Internal Revenue Service IRS. Section 2164 and Section 2165 - Non-residents with Canadian rental income Deadlines. The 15th of April is typically the due date to file taxes for tax purposes for the Internal Revenue Service IRS. Filing due date for 2020 tax returns for individuals and pay balance due if any to the CRA. June 15 2021 is the deadline for self-employed individuals to file their 2020 income tax and benefit return.

Source: pinterest.com

Source: pinterest.com

In case of balance owing for 2020 it still has to be paid before 30 April 2021. Are you tax savvy. Canadas 2021 tax deadline is still April 30. In case of balance owing for 2020 it still has to be paid before 30 April 2021. Filing deadline for certain flow-through entities and trusts includes partnerships S corporations foreign grantor trusts and certain other entities and taxpayers.

Source: sterncohen.com

Source: sterncohen.com

Apr 30 2021. In case of balance owing for 2020 it still has to be paid before 30 April 2021. Youll need form 4868 to do so and you can also file electronically for an automatic. 4 things you need to. Larger font Increase article font size.

Source: myexpattaxes.com

Source: myexpattaxes.com

22 2021 with April 30 set as the deadline for individual taxpayers Getty Imagesizusek Its tax season again. Filing deadline for certain flow-through entities and trusts includes partnerships S corporations foreign grantor trusts and certain other entities and taxpayers. The tax deadline for 2022 has changed. This year we are encouraging you to file your return electronically and as soon as possible. In a major development the government on Friday said there is no proposal to extend the deadline for filing income tax returns beyond its current deadline of December 31 as per a PTI report.

Source: fbc.ca

Source: fbc.ca

The income tax return ITR filing deadline for FY 2020-21 December 31 2021 was not extended any further by the government. Tax deadline in 2021 In 2021 it appears the CRA will stick to the usual deadline. The Canada Revenue Agency CRA is here to support you and your business in meeting your tax obligations. Personal tax filing for self-employed individuals Sole Proprietors The deadline is on. The income tax return ITR filing deadline for FY 2020-21 December 31 2021 was not extended any further by the government.

Source: fbc.ca

Source: fbc.ca

For incorporated businesses that. For small businesses the filing deadline remains as June 15th unchanged. Last day of the tax year. Despite renewed school and business shut-downs in. The tax deadline for 2022 has changed.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when is tax filing deadline 2021 canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.