Your When can i start filing taxes for 2021 sars images are available in this site. When can i start filing taxes for 2021 sars are a topic that is being searched for and liked by netizens today. You can Download the When can i start filing taxes for 2021 sars files here. Download all royalty-free photos.

If you’re searching for when can i start filing taxes for 2021 sars pictures information connected with to the when can i start filing taxes for 2021 sars topic, you have visit the right site. Our site frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

When Can I Start Filing Taxes For 2021 Sars. When you click File Return your ITR12 return will be submitted to SARS. Every year SARS announces its Tax Season a period during which you are required to submit your annual income tax return. See our 2021 Filing Season webpage for more information. The 2021 tax year refers to the period 1 March 2020 to 28 February 2022.

Faq How Do I Get To The Income Tax Work Page To See My Income Tax Return Itr12 South African Revenue Service From sars.gov.za

Faq How Do I Get To The Income Tax Work Page To See My Income Tax Return Itr12 South African Revenue Service From sars.gov.za

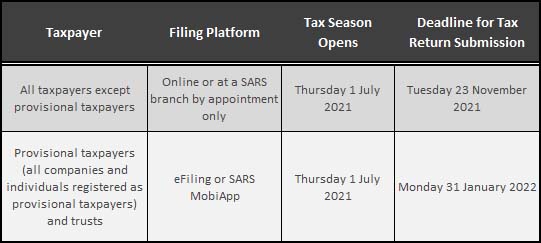

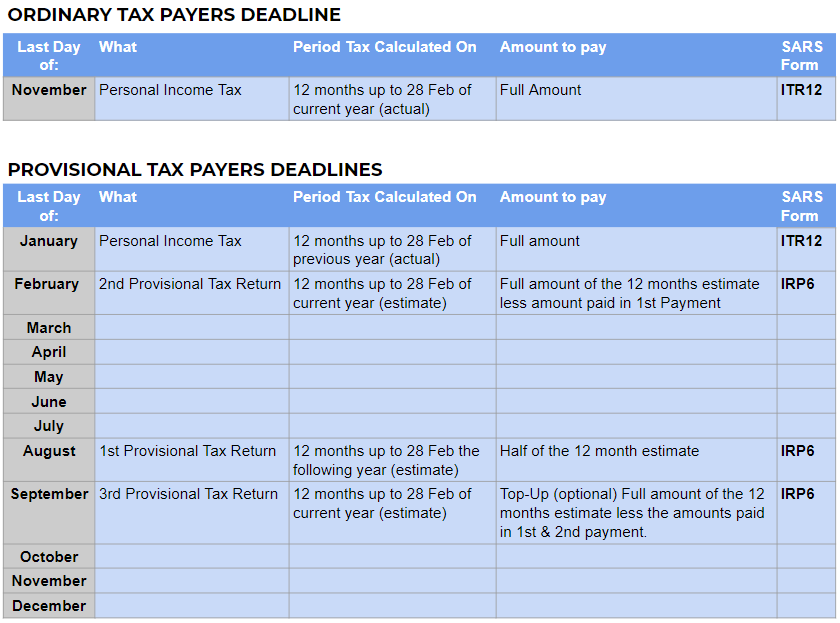

Provisional taxpayers who file online electronically - 1 July to 28 January 2022. The revenue collector added that a significant number of individual. Provisional taxpayers will be required to file their tax returns as from 1 September with the filing deadline of 31 January 2021. 1 July to 23 November 2021 This is the period for taxpayers who file online. This is despite an overwhelming response from taxpayers who have submitted their personal income tax returns since July this year SARS said. The income tax return which should be completed by individuals is known as.

HOW TO eFILE YOUR.

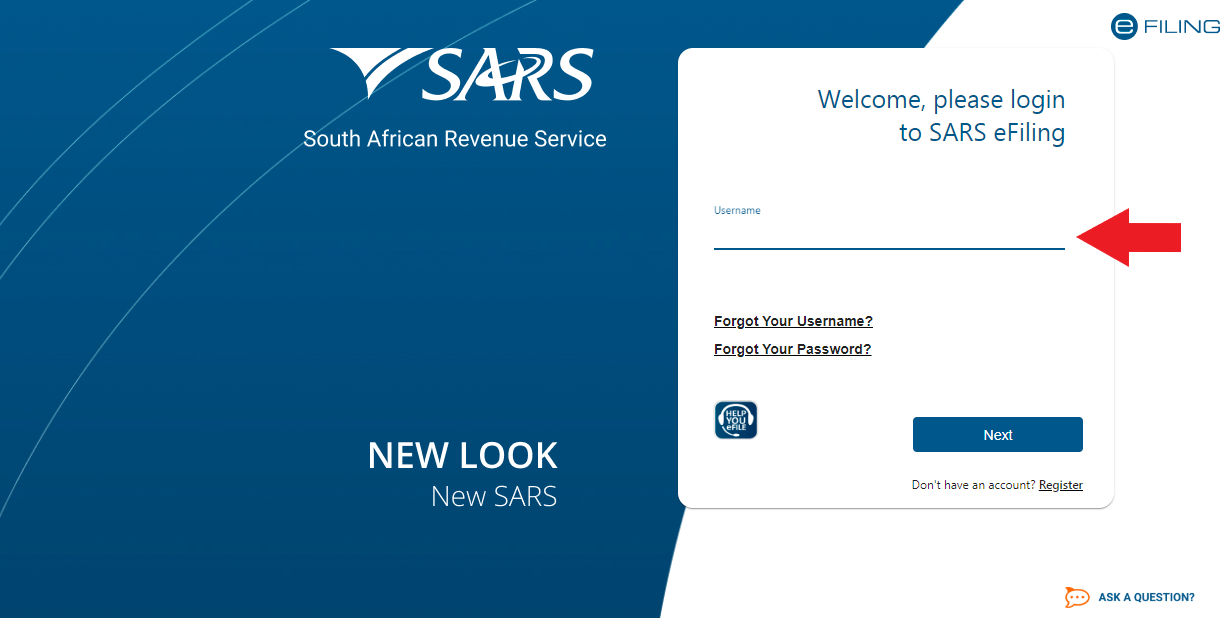

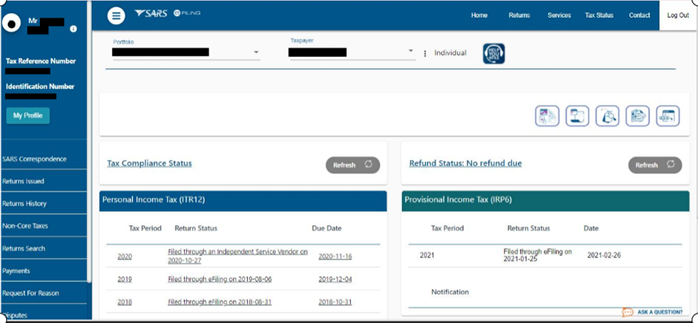

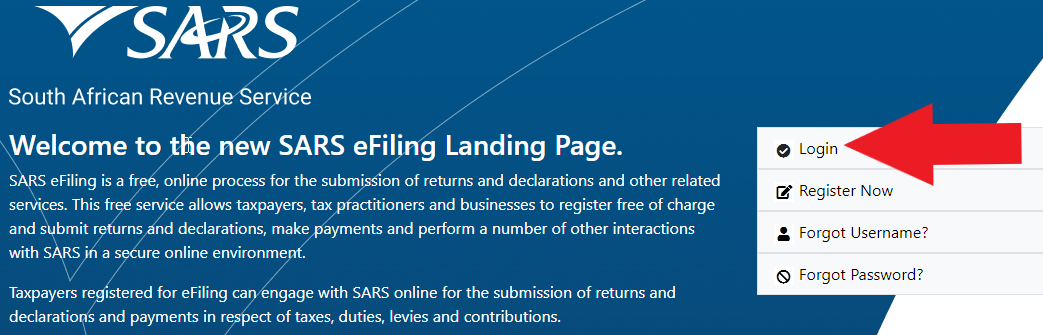

The current tax year 1 March 2022 to 28 February 2022 in South Africa is called the 2022 tax year because the tax year is named by the year in which it ends. See our 2021 Filing Season webpage for more information. When you click File Return your ITR12 return will be submitted to SARS. Even though taxes for most taxpayers are due by April 15 2021 you can e-file electronically file your taxes earlier. This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with SARS in a secure online environment. If you owe SARS money you can make a payment on eFiling via EFT or the SARS MobiApp by the specified due date on your Notice of Assessment.

Source: youtube.com

Source: youtube.com

FILE YOUR INCOME TAX RETURN ITR12 At any stage you can save your ITR12 return before filingby clicking on Save Return. Individual income tax return filing dates. EFiling will check the correctness of specific. Taxpayers who cannot file online can do so at a SARS branch by appointment only. Employers are required to submit their Employer Reconciliation Declaration EMP501 to SARS by 31 May as well as outstanding monthly.

Source: nexia-sabt.co.za

Source: nexia-sabt.co.za

1 July to 23 November 2021. BusinessTech 25 May 2021 The South African Revenue Services SARS has announced that taxpayers will be able to file their tax returns from 1 July 2021. 1 July to 23 November 2021. 1 July to 23 November 2021. This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with SARS in a secure online environment.

Source: findanaccountant.co.za

Source: findanaccountant.co.za

SARS said that the other important dates that taxpayers should be aware of are. The revenue collector added that a significant number of individual. Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp. Again the general SARS waiting periods apply and an appeal can take up to 60 days to be finalised. For the 2021 year of assessment the tax threshold amounts are.

Source: taxtim.com

Source: taxtim.com

1 July to 31 January 2022. 1 July to 23 November 2021. EFiling will check the correctness of specific. The IRS likely will begin accepting electronic returns anywhere between Jan. This needs to be submitted within 30 days of receiving your notification of your objection being declined.

Source: tech-talk.co.za

Source: tech-talk.co.za

1 July to 23 November 2021 This is the period for taxpayers who file online. 1 July to 23 November 2021. Every year SARS announces its Tax Season a period during which you are required to submit your annual income tax return. DEADLINES FOR INDIVIDUAL TAXPAYERS. Taxpayers who file online.

Source: taxtim.com

Source: taxtim.com

1 July to 23 November 2021. The income tax return which should be completed by individuals is known as. Individual income tax return filing dates for 2021 Covid-19 Lockdown. IR-2021-217 November 8 2021 WASHINGTON The Internal Revenue Service today encouraged taxpayers including those who received stimulus payments or advance Child Tax Credit payments to take important steps this fall to help them file their federal tax returns in 2022. Taxpayers who cannot file online can do so at a SARS branch by appointment only.

Source: sars.gov.za

Source: sars.gov.za

HOW TO eFILE YOUR. This is despite an overwhelming response from taxpayers who have submitted their personal income tax returns since July this year SARS said. Employers are required to submit their Employer Reconciliation Declaration EMP501 to SARS by 31 May as well as outstanding monthly. Taxpayers who file online - 1 July to 23 November 2021. This needs to be submitted within 30 days of receiving your notification of your objection being declined.

Source: taxtim.com

Source: taxtim.com

Taxpayers who file online. SARS said that the other important dates that taxpayers should be aware of are. 1 July 2021 Filing Season for Individuals opens today. FILE YOUR INCOME TAX RETURN ITR12 At any stage you can save your ITR12 return before filingby clicking on Save Return. We will update this page as soon as they become available.

Source: sme.tax

Source: sme.tax

Most of the 2021 Tax Forms and schedules have not been released by the IRS. Individual income tax return filing dates for 2021 Covid-19 Lockdown. Individual income tax return filing dates. Employers are required to submit their Employer Reconciliation Declaration EMP501 to SARS by 31 May as well as outstanding monthly. Taxpayers who file online.

Source: taxtim.com

Source: taxtim.com

Planning ahead can help people file an accurate return and avoid processing delays that. HOW TO eFILE YOUR. EFiling will check the correctness of specific. 1 July to 23 November 2021. In extreme cases if SARS still disallows your deduction after a notice of objection you can file a notice of appeal.

Source: m.polity.org.za

Source: m.polity.org.za

IR-2021-16 January 15 2021 WASHINGTON The Internal Revenue Service announced that the nations tax season will start on Friday February 12 2021 when the tax agency will begin accepting and processing 2020 tax year returns. SARS states that as an individual South African tax resident you do not need to submit an income tax return for the 2021 year of assessment if. HOW TO eFILE YOUR. Taxpayers who file online. Taxpayers who cannot file online can do so at a SARS branch by appointment only.

Source: onestopaccounting.co.za

Source: onestopaccounting.co.za

BusinessTech 25 May 2021 The South African Revenue Services SARS has announced that taxpayers will be able to file their tax returns from 1 July 2021. The 2021 year of assessment commonly referred to as a tax year runs from 1 March 2020 to 28 February 2021. It is important that you as the taxpayer comply with the relevant tax return submission deadlines and maintain a compliant status at SARS - let us guide and advise you with your taxes. Taxpayers who file online. 1 July to 23 November 2021.

Source: news24.com

Source: news24.com

1 July to 23 November 2021. Taxpayers who cannot file online can do so at a SARS branch by appointment only. 1 July to 31 January 2022. The revenue collector added that a significant number of individual. This needs to be submitted within 30 days of receiving your notification of your objection being declined.

Source: sars.gov.za

Source: sars.gov.za

The current tax year 1 March 2022 to 28 February 2022 in South Africa is called the 2022 tax year because the tax year is named by the year in which it ends. Once you have captured all the information on your ITR12 return and are ready to submit to SARS simply click File Return. This needs to be submitted within 30 days of receiving your notification of your objection being declined. In extreme cases if SARS still disallows your deduction after a notice of objection you can file a notice of appeal. Taxpayers who cannot file online can do so at a SARS branch by appointment only.

Source: sars.gov.za

Source: sars.gov.za

Taxpayers who file online. Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp. IR-2021-217 November 8 2021 WASHINGTON The Internal Revenue Service today encouraged taxpayers including those who received stimulus payments or advance Child Tax Credit payments to take important steps this fall to help them file their federal tax returns in 2022. We will update this page as soon as they become available. The 2021 year of assessment commonly referred to as a tax year runs from 1 March 2020 to 28 February 2021.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title when can i start filing taxes for 2021 sars by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.