Your What is the tax filing deadline for 2021 in texas images are ready in this website. What is the tax filing deadline for 2021 in texas are a topic that is being searched for and liked by netizens now. You can Find and Download the What is the tax filing deadline for 2021 in texas files here. Download all royalty-free vectors.

If you’re looking for what is the tax filing deadline for 2021 in texas images information related to the what is the tax filing deadline for 2021 in texas interest, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

What Is The Tax Filing Deadline For 2021 In Texas. Whats the fastest way to file my tax return. When is Tax Deadline 2021. The fastest way to file your tax return is to file electronically. Now that the deadline 31 December 2021 for the filing of FY 2020-21 Income Tax Return ITR is over those who failed to file their tax return must be wondering about the next thing they should do.

2021 Tax Filing Deadline Extended For Texas Oklahoma And Louisiana From blog.taxact.com

2021 Tax Filing Deadline Extended For Texas Oklahoma And Louisiana From blog.taxact.com

The fastest way to file your tax return is to file electronically. HM Revenue and Customs is waiving late filing and late payment penalties for one month to give people extra time to complete their 2020 to 2021 tax return and pay any money owed. Now that the deadline 31 December 2021 for the filing of FY 2020-21 Income Tax Return ITR is over those who failed to file their tax return must be wondering about the next thing they should do. AUSTIN Texas - The IRS is reminding Texas taxpayers the deadline to file their 2020 federal income tax return is June 15 2021. Note that special filing deadlines apply in certain. Incase you too are one among the above lot you must not worry.

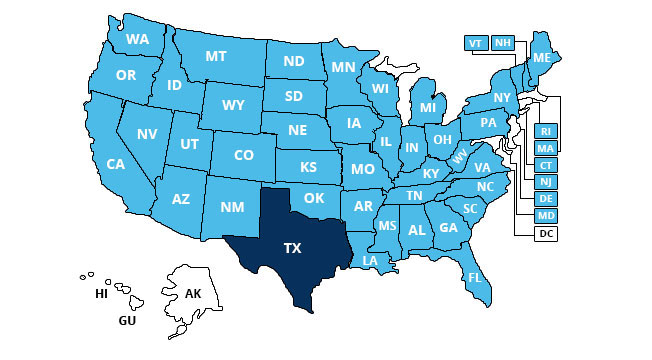

The tax filing deadline has been extended to June 15 2021 for all Texas Oklahoma and Louisiana residents so they can complete their returns in time.

1 For the few entities who do not have a first day to file. Note that special filing deadlines apply in certain. Because the tax return is electronically transmitted to the IRS you dont have to. In addition the Texas Comptrollers office has postponed the due date for 2021 state franchise tax reports Accounting Year from May 15 to June 15. For the May 1 2021 election Wednesday January 13 2021 is the deadline to post notice of candidate filing deadline for local political subdivisions that do not have a first day to file for their candidates. As a result affected individuals and businesses will have until June 15 2021 to file returns and pay any tax that would otherwise be due during this period.

Source: blog.taxact.com

Source: blog.taxact.com

The following Federal tax deadlines have been postponed to June 15 2021 for taxpayers affected by Texas Winter Storms DR-4586-TX. Texas Comptroller Glenn Hegar announced his agency is extending the 2021 franchise tax reports due date from May 15 to June 15. The tax filing deadline has been extended to June 15 2021 for all Texas Oklahoma and Louisiana residents so they can complete their returns in time. Wondering how all of those changes might affect your tax deadlines for the 2021 tax year taxes youll file in 2022. As a result of the winter storm Texans have until June 15 2021 to file various individual and business tax returns and make tax payments according to the Internal Revenue Service.

Source: greenbacktaxservices.com

Source: greenbacktaxservices.com

Partnership Tax Returns Form 1065 Originally due March 15 2021 S-Corporation Tax Returns Form 1120-S Originally due March 15 2021 Corporation Tax Returns Form 1120 Originally due April 15 2021. As a result affected individuals and businesses will have until June 15 2021 to file returns and pay any tax that would otherwise be due during this period. HM Revenue and Customs is waiving late filing and late payment penalties for one month to give people extra time to complete their 2020 to 2021 tax return and pay any money owed. The extension applies to residents in all 254 counties since all were included in a federal disaster declaration. The deadline to file a federal tax return has been extended to June 15 2021 for all Texas Oklahoma and Louisiana residents and businesses.

Source: hrblock.com

Source: hrblock.com

Because the tax return is electronically transmitted to the IRS you dont have to. LinkedIn Facebook Twitter. The IRS announced in February that victims of the Texas winter storm would have until June 15 to file their 2020 taxes. The deadline to file a federal tax return has been extended to June 15 2021 for all Texas Oklahoma and Louisiana residents and businesses. Lynn Hamilton Butler Doug Jones Albert Lin.

Source: efile.com

Source: efile.com

In addition the Texas Comptrollers office has postponed the due date for 2021 state franchise tax reports Accounting Year from May 15 to June 15. When is the deadline to file tax returns in Texas. Partnership Tax Returns Form 1065 Originally due March 15 2021 S-Corporation Tax Returns Form 1120-S Originally due March 15 2021 Corporation Tax Returns Form 1120 Originally due April 15 2021. The Texas auditor has adjusted for the 2020 IRS extension for federal tax returns due to the COVID19 pandemic so guidance needs to be provided. Preliminary Findings of 2020 Election Audit Finds Little Trouble in Big Texas Counties For instance certain deadlines falling on or after February 11 2021 and before June 15 2021 are postponed.

Source: cbh.com

Source: cbh.com

As a result affected individuals and businesses will have until June 15 2021 to file returns and pay any tax that would otherwise be due during this period. E-filing your tax return to the IRS is more secure than paper filing. In addition the Texas Comptrollers office has postponed the due date for 2021 state franchise tax reports Accounting Year from May 15 to June 15. For the May 1 2021 election Wednesday January 13 2021 is the deadline to post notice of candidate filing deadline for local political subdivisions that do not have a first day to file for their candidates. The Texas auditor has adjusted for the 2020 IRS extension for federal tax returns due to the COVID19 pandemic so guidance needs to be provided.

Source: blog.taxact.com

Source: blog.taxact.com

Filing your LLC taxes is important but relatively easy if you follow the correct steps and meet all the necessary deadlines. The Texas auditor has adjusted for the 2020 IRS extension for federal tax returns due to the COVID19 pandemic so guidance needs to be provided. Texas Comptrollers Office Extends Franchise Tax Deadline AUSTIN In response to the recent winter storm and power outages in the state Texas Comptroller Glenn Hegar announced today that his agency is automatically extending the due date for 2021 franchise tax reports from May 15 to June 15. To date the Texas Inspector has not extended the customary deadline for filing the Texas tax return on May 15 2021 and the related Texas franchise tax. The extension applies to residents in all 254 counties since all were included in a federal disaster declaration.

Source: forbes.com

Source: forbes.com

The Texas auditor has adjusted for the 2020 IRS extension for federal tax returns due to the COVID19 pandemic so guidance needs to be provided. When is Tax Deadline 2021. The IRS announced in February that victims of the Texas winter storm would have until June 15 to file their 2020 taxes. Incase you too are one among the above lot you must not worry for you still have a chance to file your ITR. HM Revenue and Customs is waiving late filing and late payment penalties for one month to give people extra time to complete their 2020 to 2021 tax return and pay any money owed.

Source: sginccpa.com

Source: sginccpa.com

When is the deadline to file tax returns in Texas. As a result of the winter storm Texans have until June 15 2021 to file various individual and business tax returns and make tax payments according to the Internal Revenue Service. No additional forms are needed to file. WASHINGTON Victims of this months winter storms in Texas will have until June 15 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. AUSTIN Texas - The IRS is reminding Texas taxpayers the deadline to file their 2020 federal income tax return is June 15 2021.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

As a result affected individuals and businesses will have until June 15 2021 to file returns and pay any tax that would otherwise be due during this period. Due to the winter storm that left millions without power and water mid-February the IRS has extended the filing deadline to allow those impacted more time to complete their returns. When is Tax Deadline 2021. WASHINGTON Victims of this months winter storms in Texas will have until June 15 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. IRS Extends 2021 Tax Filing Deadline For Texas Taxpayers Impacted By Winter Storm.

Source: cnbc.com

Source: cnbc.com

Preliminary Findings of 2020 Election Audit Finds Little Trouble in Big Texas Counties For instance certain deadlines falling on or after February 11 2021 and before June 15 2021 are postponed. This includes 2020 individual and business tax returns normally due on April 15 as well as 2020 business returns. Texas Comptroller Glenn Hegar announced his agency is extending the 2021 franchise tax reports due date from May 15 to June 15. WASHINGTON Victims of this months winter storms in Texas will have until June 15 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. When is Tax Deadline 2021.

Source: smartasset.com

Source: smartasset.com

No additional forms are needed to file. The IRS announced in February that victims of the Texas winter storm would have until June 15 to file their 2020 taxes. Due to the winter storm that left millions without power and water mid-February the IRS has extended the filing deadline to allow those impacted more time to complete their returns. Filing your LLC taxes is important but relatively easy if you follow the correct steps and meet all the necessary deadlines. The Texas auditor has adjusted for the 2020 IRS extension for federal tax returns due to the COVID19 pandemic so guidance needs to be provided.

Source: smartasset.com

Source: smartasset.com

LinkedIn Facebook Twitter. Self Assessment taxpayers are being given more time to file their return - with deadlines and late payment fines being pushed back because of Covid19. Incase you too are one among the above lot you must not worry. Texas Comptrollers Office Extends Franchise Tax Deadline AUSTIN In response to the recent winter storm and power outages in the state Texas Comptroller Glenn Hegar announced today that his agency is automatically extending the due date for 2021 franchise tax reports from May 15 to June 15. The deadline to file a federal tax return has been extended to June 15 2021 for all Texas Oklahoma and Louisiana residents and businesses.

Source: howtostartanllc.com

Source: howtostartanllc.com

Preliminary Findings of 2020 Election Audit Finds Little Trouble in Big Texas Counties For instance certain deadlines falling on or after February 11 2021 and before June 15 2021 are postponed. 1 For the few entities who do not have a first day to file. This postponement is automatic and does not require taxpayers to file additional forms. This includes 2020 individual and business tax returns normally due on April 15 as well as 2020 business returns. Lynn Hamilton Butler Doug Jones Albert Lin.

C corporations in Texas Oklahoma and Louisiana have until June 15 to submit their tax returns. Lynn Hamilton Butler Doug Jones Albert Lin. Wondering how all of those changes might affect your tax deadlines for the 2021 tax year taxes youll file in 2022. As a result of the winter storm Texans have until June 15 2021 to file various individual and business tax returns and make tax payments according to the Internal Revenue Service. The IRS announced in February that victims of the Texas winter storm would have until June 15 to file their 2020 taxes.

Source: tsnamerica.com

Source: tsnamerica.com

WASHINGTON Victims of this months winter storms in Texas will have until June 15 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. Note that special filing deadlines apply in certain. The Texas auditor has adjusted for the 2020 IRS extension for federal tax returns due to the COVID19 pandemic so guidance needs to be provided. This includes 2020 individual and business tax returns normally due on April 15 as well as 2020 business returns. Self Assessment taxpayers are being given more time to file their return - with deadlines and late payment fines being pushed back because of Covid19.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the tax filing deadline for 2021 in texas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.