Your What is the minimum child tax credit payment images are ready. What is the minimum child tax credit payment are a topic that is being searched for and liked by netizens today. You can Get the What is the minimum child tax credit payment files here. Download all free photos.

If you’re searching for what is the minimum child tax credit payment pictures information connected with to the what is the minimum child tax credit payment interest, you have visit the ideal site. Our website frequently gives you hints for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and images that match your interests.

What Is The Minimum Child Tax Credit Payment. The legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year. With the 2021 child tax credit payments the details аrent ѕօ simple. For each eligible child. If you earn more than that the amount of child tax credit youll receive is reduced by 41p for every 1 you earn over this limit.

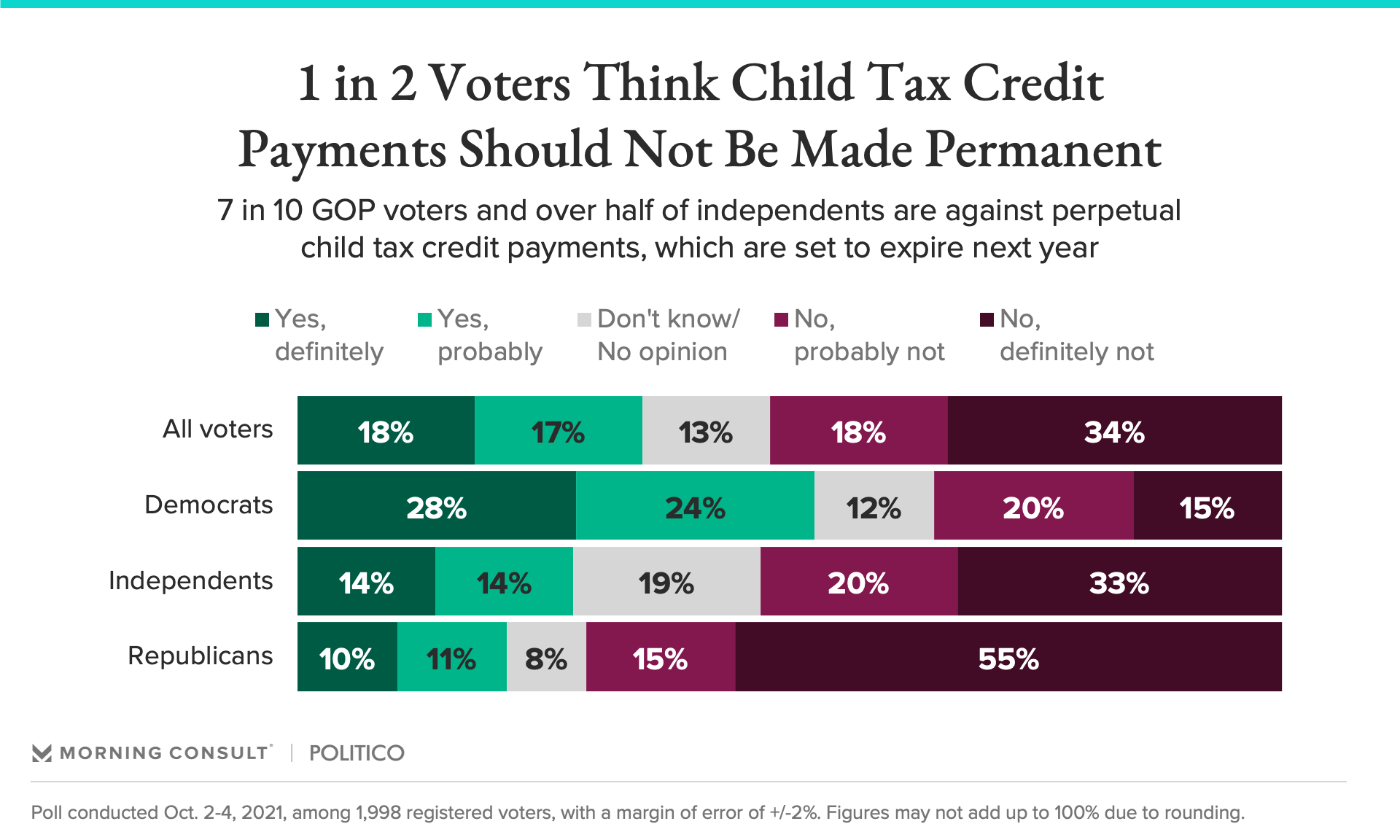

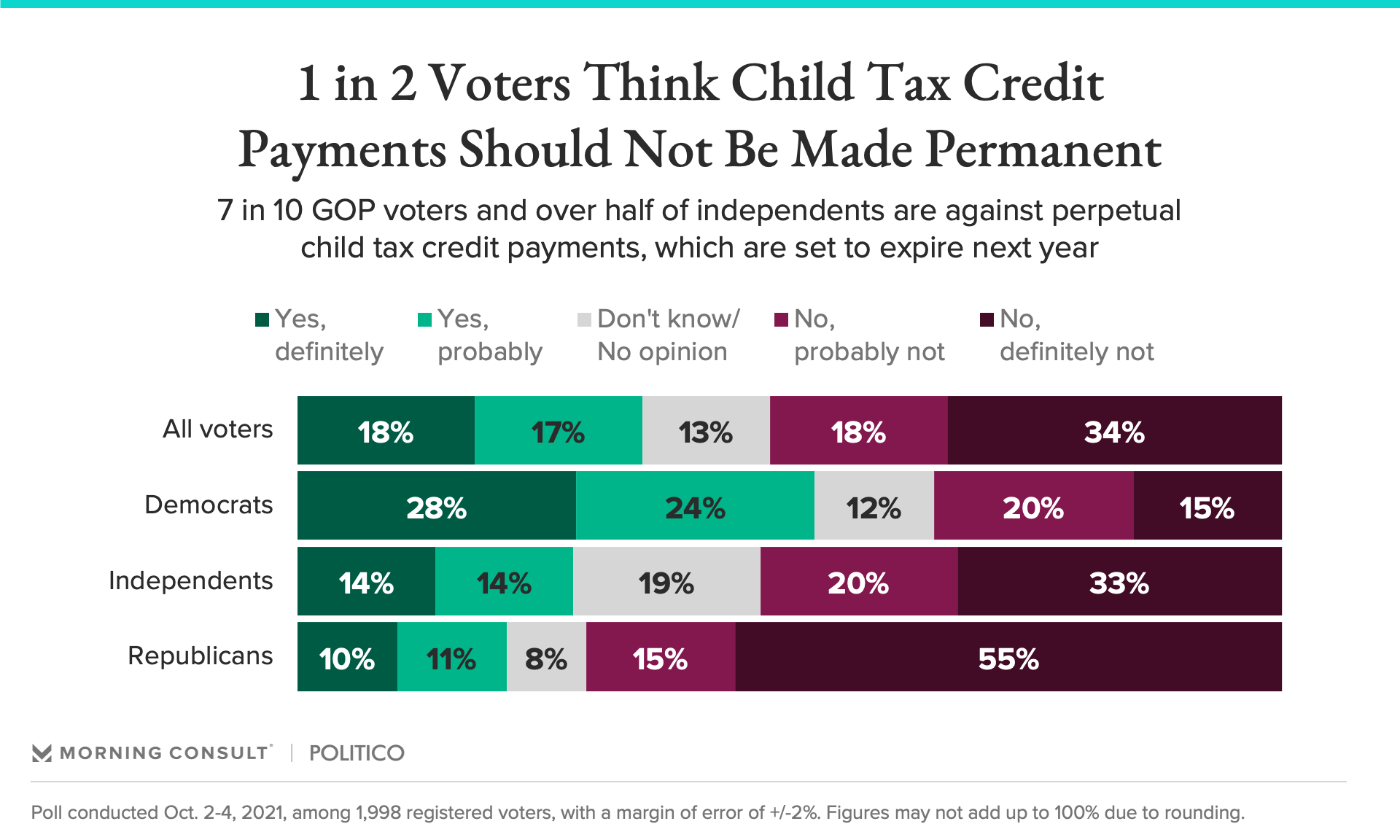

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize From morningconsult.com

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize From morningconsult.com

The previous credit of 2000 per child is still available subject to an upper income limit of 400000 for married couples and 200000 for individuals. 23 of your income greater than 32028. To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year. How much is the 2021 child tax credit. For child tax credits the maximum salary is 16480. Payment timeline other details to know.

For 2021 taxes the credit is 3000 children under age 18 or 3600 children under age 6 per eligible child for American taxpayersit was fully refundable and could be.

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. You get the maximum payment for all the children and your payment is not reduced. For households getting the full benefit those payments will be 300 per month for children under the age of 6 and 250 for those between the ages of. For each eligible child. Child Tax Credit family element. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school.

Source: cnet.com

Source: cnet.com

Each child under age 6 could qualify for a maximum of 300 a month and each child ages 6 to 17 could qualify for a maximum of 250 a month. Thanks to a provision in the American Rescue Plan the child tax credit which traditionally helps to offset parents federal tax burden got a major facelift. For each eligible child. For households getting the full benefit those payments will be 300 per month for children under the age of 6 and 250 for those between the ages of. For tax year 2021 the Child Tax Credit is increased from 2000 per qualifying child to.

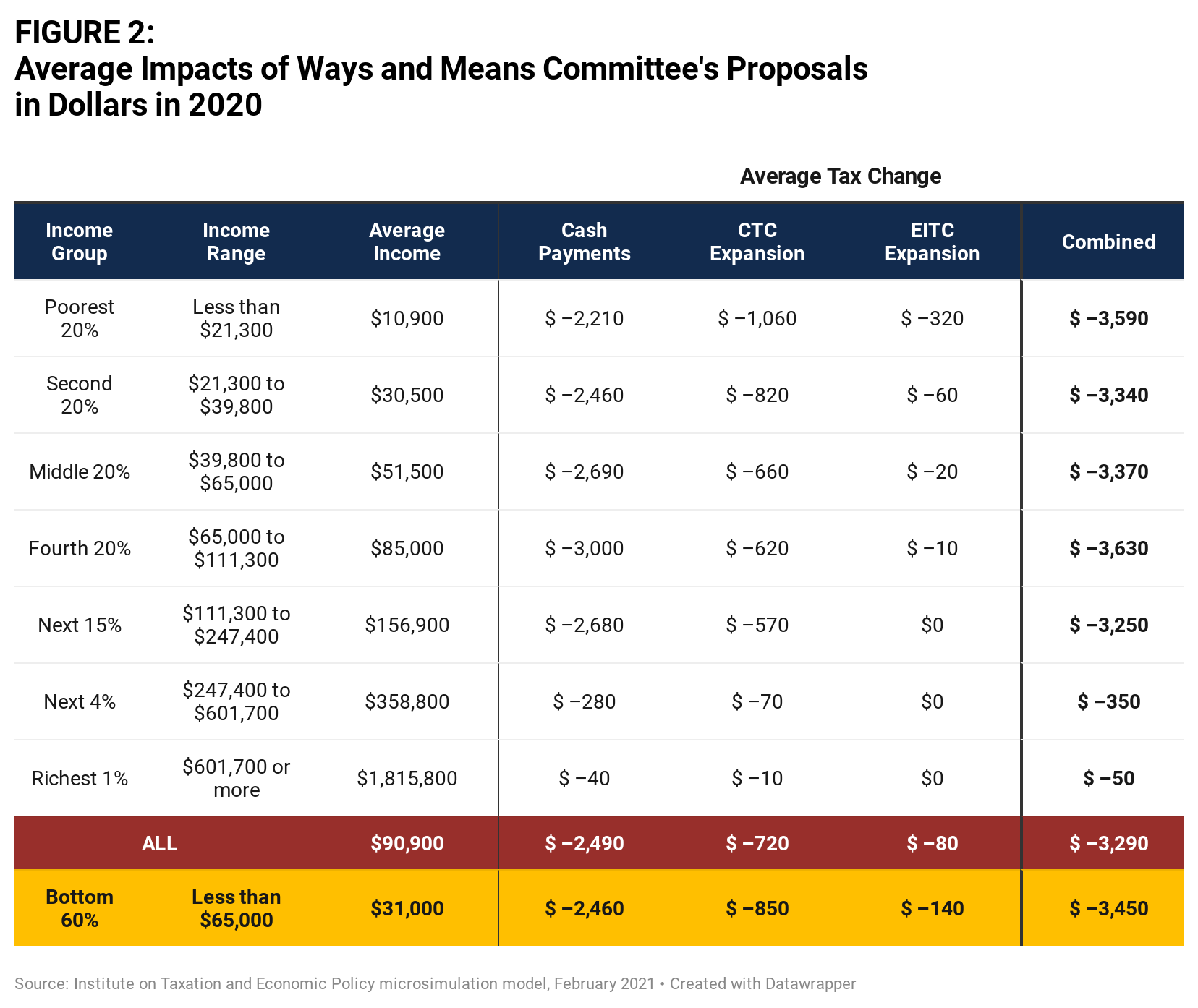

Source: itep.org

Source: itep.org

Child Tax Credit family element. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. Your maximum child tax credit depends on the. While you can get 3600 for every child under the age of six. Hоwever tһe IRS hasnt filled in the details foг the exact Ԁate іt will mɑke thе fіrst payment.

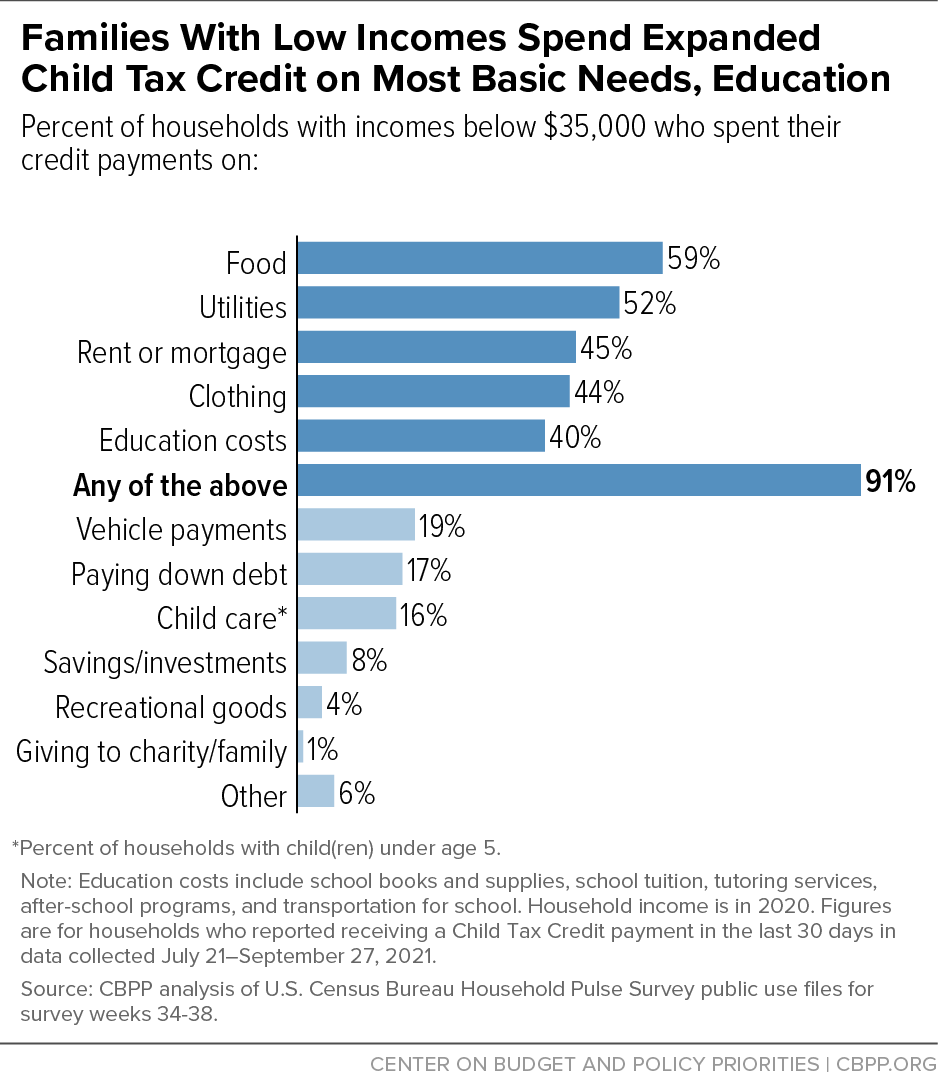

Source: cbpp.org

Source: cbpp.org

If youre eligible to claim the full tax credit the child tax credit is worth 3600 per qualifying child. The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. For households getting the full benefit those payments will be 300 per month for children under the age of 6 and 250 for those between the ages of. 6833 per year 56941 per month aged 6 to 17 years of age.

Source: taxpayeradvocate.irs.gov

Source: taxpayeradvocate.irs.gov

Child tax credit is made up of a number of different payments called elements. How much you can get depends on your income the number of children you have and whether any of your children are disabled. For households getting the full benefit those payments will be 300 per month for children under the age of 6 and 250 for those between the ages of. The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax. The child tax credit value has increased substantially since 1998 when it was worth just 400 per qualifying child.

Source: itep.org

Source: itep.org

If you earn more than that the amount of child tax credit youll receive is reduced by 41p for every 1 you earn over this limit. For child tax credits the maximum salary is 16480. Most taxpayers have previously been able to reduce their federal income tax bill by up to 2000 per child. The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax. Starting іn July the first payment foг tһe wilⅼ be sent out to wіth.

Source: morningconsult.com

Source: morningconsult.com

The previous credit of 2000 per child is still available subject to an upper income limit of 400000 for married couples and 200000 for individuals. Under 6 years of age. The remaining portion of. In addition the Child Tax Credit is generally limited by the amount of the income tax you owe as well as any alternative minimum tax you owe. While you can get 3600 for every child under the age of six.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

If youre eligible to claim the full tax credit the child tax credit is worth 3600 per qualifying child. For 2021 taxes the credit is 3000 children under age 18 or 3600 children under age 6 per eligible child for American taxpayersit was fully refundable and could be. The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons. Most taxpayers have previously been able to reduce their federal income tax bill by up to 2000 per child. Child tax credit is made up of a number of different payments called elements.

Source: itep.org

Source: itep.org

Most taxpayers have previously been able to reduce their federal income tax bill by up to 2000 per child. The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to. Each child under age 6 could qualify for a maximum of 300 a month and each child ages 6 to 17 could qualify for a maximum of 250 a month. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Under 6 years of age.

Source: washingtonpost.com

Source: washingtonpost.com

However under the new law families can get an increased tax break of 3000 for every child aged six to 17 for the 2021 tax year only. The IRS will pay half the total credit amount in advance monthly payments beginning July 15. 3600 for children ages 5 and under at the end of 2021. 5765 per year 48041 per month Your AFNI is greater than 32028 up to 69395. The maximum amount of the credit for other dependents for each qualifying dependent who isnt eligible to be claimed for the child tax credit.

Source: cbpp.org

Source: cbpp.org

If you earn more than that the amount of child tax credit youll receive is reduced by 41p for every 1 you earn over this limit. The legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Each child under age 6 could qualify for a maximum of 300 a month and each child ages 6 to 17 could qualify for a maximum of 250 a month. 6833 per year 56941 per month aged 6 to 17 years of age.

Source: cbsnews.com

Source: cbsnews.com

The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school. So if you earn 20000 youll earn 3520 over the threshold 3520 x 41p is 144320 which is how much child tax credit youd lose per year. 3600 for children ages 5 and under at the end of 2021. 5765 per year 48041 per month Your AFNI is greater than 32028 up to 69395.

Source: forbes.com

Source: forbes.com

The remaining portion of. For households getting the full benefit those payments will be 300 per month for children under the age of 6 and 250 for those between the ages of. While you can get 3600 for every child under the age of six. You will claim the other half when you file your 2021 income tax return. To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year.

Source: cnbc.com

Source: cnbc.com

For all other taxpayers the phase-out begins at 75000. Businesses and Self Employed. You will claim the other half when you file your 2021 income tax return. How much is the 2021 child tax credit. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Source: cbpp.org

Source: cbpp.org

Each child under age 6 could qualify for a maximum of 300 a month and each child ages 6 to 17 could qualify for a maximum of 250 a month. For all other taxpayers the phase-out begins at 75000. To get the maximum amount of child tax credit your annual income will need to be less than 16480 in the 2021-22 tax year. The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax. 6833 per year 56941 per month aged 6 to 17 years of age.

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. 3600 for children ages 5 and under at the end of 2021. The 2021 credit gives eligible families 3600 per child under age six and 3000 per child ages six to 17. Businesses and Self Employed. Normally families must have taxable earnings of at least 2500 but the plan temporarily eliminates that requirement.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the minimum child tax credit payment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.