Your What is the child tax credit payment program images are ready in this website. What is the child tax credit payment program are a topic that is being searched for and liked by netizens today. You can Download the What is the child tax credit payment program files here. Get all royalty-free images.

If you’re searching for what is the child tax credit payment program images information related to the what is the child tax credit payment program keyword, you have come to the right site. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

What Is The Child Tax Credit Payment Program. Only one enhanced child tax credit payment is left following the six scheduled checks that went out in 2021. Will you get 1800 more per kid this year. Started as a 500 per child write-off under Bill Clinton in 1997 it changed over time and was beefed up under Donald Trumps GOP tax cuts in 2017. The amount of credit you receive is based on your income and the number of qualifying children you are claiming.

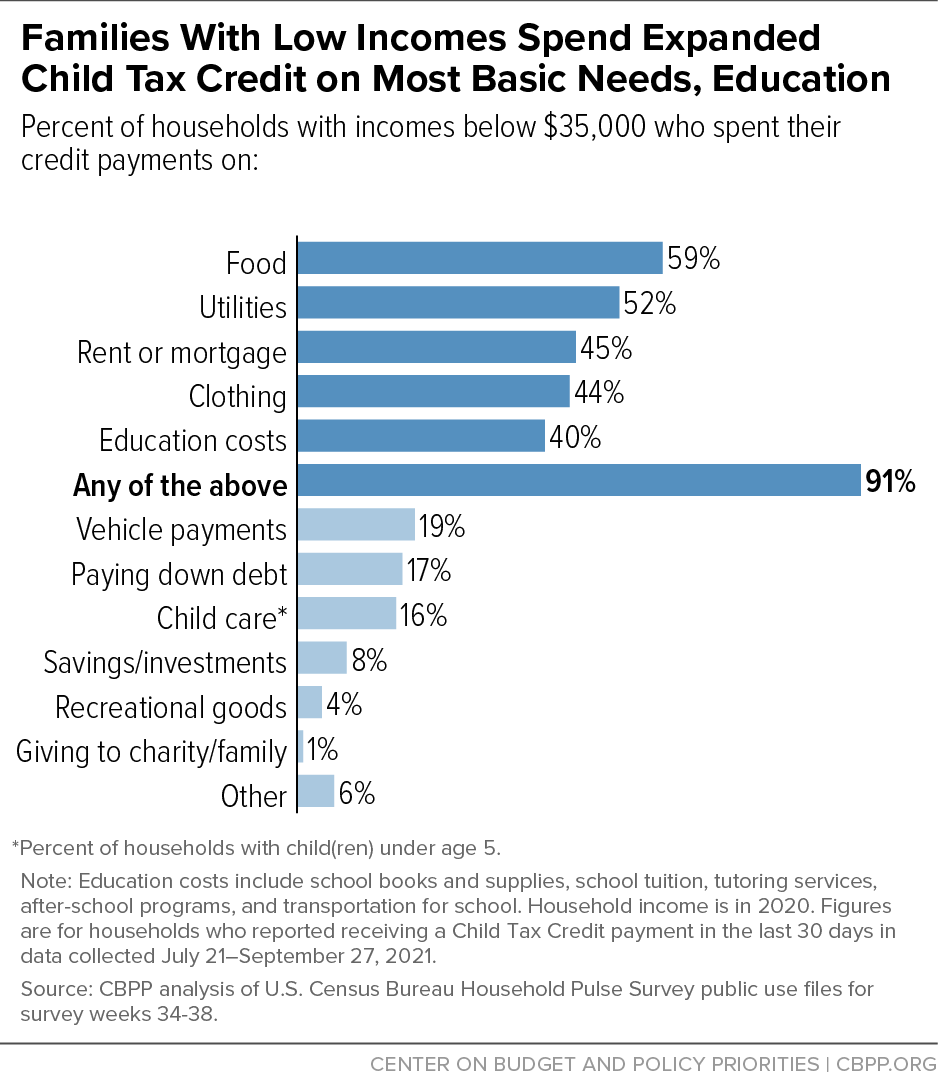

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay For Necessities Education Center On Budget And Policy Priorities From cbpp.org

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay For Necessities Education Center On Budget And Policy Priorities From cbpp.org

By the end of. These changes apply to tax year 2021 only. But under the new rules they could receive the full 3000 or. The child tax credit payments you got in 2021 could impact your taxes this year in a few ways. Millions of parents across the US. Can expect to receive some extra cash this week when the IRS will start distributing the sixth and final payment from the expanded child tax credit.

These changes apply to tax year 2021 only.

Child Tax Credit highlights. Some families opted out of receiving the monthly payments in favor or receiving one lump sum or because they were worried about owing money on their taxes. Only one enhanced child tax credit payment is left following the six scheduled checks that went out in 2021. Bidens American Rescue Plan increased the credit. With six advance monthly child tax credit checks sent out last year only one payment is left. The payments you receive are an advance of the Child Tax Credit that you would normally get when you file your 2021 tax return.

Originally enacted as part of the Taxpayer Relief Act of 1997 the child tax credit was initially a 500 nonrefundable credit that could be applied by eligible families toward their federal income. With six advance monthly child tax credit checks sent out last year only one payment is left. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Filing 2021 taxes will look slightly different for families who received the enhanced child tax credit last year. The payments you receive are an advance of the Child Tax Credit that you would normally get when you file your 2021 tax return.

Source: marca.com

Source: marca.com

By the end of. Following some confusion over the payment of Child Tax Credit the White House and Treasury Department have worked together with Code for America to launch a new. Some families opted out of receiving the monthly payments in favor or receiving one lump sum or because they were worried about owing money on their taxes. The advance payments of the child tax credit reflected half of a familys estimated credit. Advance Child Tax Credit.

Source: cbpp.org

Source: cbpp.org

Distributed monthly through December eligible families will receive 300 per month for each child under age 6 and 250 for kids 6 to 17. Advance Child Tax Credit. You will claim the other half when you file your 2021 income tax return. You should soon receive. This means that by accepting advance child tax credit payments the amount of your.

Source: cnet.com

Source: cnet.com

The monthly Child Tax Credit payments of up to 300 for children under six and up to 250 for children ages six to 17 began going out in July and were sent every month through December. You should soon receive. Only one enhanced child tax credit payment is left following the six scheduled checks that went out in 2021. Can expect to receive some extra cash this week when the IRS will start distributing the sixth and final payment from the expanded child tax credit. Will you get 1800 more per kid this year.

Source: cnbc.com

Source: cnbc.com

You will claim the other half when you file your 2021 income tax return. The payments you receive are an advance of the Child Tax Credit that you would normally get when you file your 2021 tax return. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. The advance payments of the child tax credit reflected half of a familys estimated credit. This means that by accepting advance child tax credit payments the amount of your.

Source: cbpp.org

Source: cbpp.org

Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1400 as a refund. Child Tax Credit highlights. To claim the other half people must enter information from the. The monthly Child Tax Credit payments of up to 300 for children under six and up to 250 for children ages six to 17 began going out in July and were sent every month through December. The big difference in 2021 is that half of the child tax credit will be paid out via monthly payments of up to 300 per child through the end of the year.

Source: taxpayeradvocate.irs.gov

Source: taxpayeradvocate.irs.gov

The payments you receive are an advance of the Child Tax Credit that you would normally get when you file your 2021 tax return. The advance payments of the child tax credit reflected half of a familys estimated credit. Can expect to receive some extra cash this week when the IRS will start distributing the sixth and final payment from the expanded child tax credit. Child Tax Credit highlights. Millions of parents across the US.

Source: forbes.com

Source: forbes.com

The child tax credit payments you got in 2021 could impact your taxes this year in a few ways. The Child Tax Credit is a tax benefit granted to American taxpayers for each qualifying dependent child. You will claim the other half when you file your 2021 income tax return. For instance if you received an overpayment and the IRS didnt adjust the amount on later payments youll need to pay that money back CNET reported. Thats because the monthly payments that were sent to.

Source: cbpp.org

Source: cbpp.org

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. Every child under the age of 17 born by the end of 2021 is eligible. Bidens American Rescue Plan increased the credit. Will you get 1800 more per kid this year. You will claim the other half when you file your 2021 income tax return.

Source: cnet.com

Source: cnet.com

Started as a 500 per child write-off under Bill Clinton in 1997 it changed over time and was beefed up under Donald Trumps GOP tax cuts in 2017. The advance payments of the child tax credit reflected half of a familys estimated credit. Some families opted out of receiving the monthly payments in favor or receiving one lump sum or because they were worried about owing money on their taxes. The payments will be made on the 15th of each month unless that date falls on a weekend or holiday. Child Tax Credit highlights.

Source: washingtonpost.com

Source: washingtonpost.com

You will claim the other half when you file your 2021 income tax return. Only one enhanced child tax credit payment is left following the six scheduled checks that went out in 2021. Youll get that money when you file your tax return this year. The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Source: cnbc.com

Source: cnbc.com

Started as a 500 per child write-off under Bill Clinton in 1997 it changed over time and was beefed up under Donald Trumps GOP tax cuts in 2017. Following some confusion over the payment of Child Tax Credit the White House and Treasury Department have worked together with Code for America to launch a new. Millions of parents across the US. With six advance monthly child tax credit checks sent out last year only one payment is left. Will you get 1800 more per kid this year.

Source: cbsnews.com

Source: cbsnews.com

Filing 2021 taxes will look slightly different for families who received the enhanced child tax credit last year. Advance Child Tax Credit. These changes apply to tax year 2021 only. Distributed monthly through December eligible families will receive 300 per month for each child under age 6 and 250 for kids 6 to 17. The advance payments of the child tax credit reflected half of a familys estimated credit.

Source: marca.com

Source: marca.com

Will you get 1800 more per kid this year. These changes apply to tax year 2021 only. For instance if you received an overpayment and the IRS didnt adjust the amount on later payments youll need to pay that money back CNET reported. You will claim the other half when you file your 2021 income tax return. The monthly Child Tax Credit payments of up to 300 for children under six and up to 250 for children ages six to 17 began going out in July and were sent every month through December.

Source: cbpp.org

Source: cbpp.org

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. The Child Tax Credit is a tax benefit granted to American taxpayers for each qualifying dependent child. Advance Child Tax Credit. You should soon receive. Originally enacted as part of the Taxpayer Relief Act of 1997 the child tax credit was initially a 500 nonrefundable credit that could be applied by eligible families toward their federal income.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the child tax credit payment program by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.