Your What is child tax credits used for images are available in this site. What is child tax credits used for are a topic that is being searched for and liked by netizens today. You can Find and Download the What is child tax credits used for files here. Find and Download all royalty-free vectors.

If you’re searching for what is child tax credits used for images information linked to the what is child tax credits used for interest, you have come to the right site. Our website frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

What Is Child Tax Credits Used For. Joe Manchin is in the spotlight for holding up key parts of the Democratic agenda. But the expanded tax credit doesnt just go to the poor. Businesses and Self Employed. The foreign equivalents of UK tax-free benefits.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning From milestonefinancialplanning.com

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning From milestonefinancialplanning.com

Similarly in the United Kingdom the tax credit is. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever. IRS Tax Tip 2020-28 March 2 2020 Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17. Some families opted out of receiving the monthly payments in favor or receiving one lump sum or because they were worried about owing money on their taxes. 112500 if filing as head of household.

For Tax Years 2018-2020 the maximum refundable portion of the credit is 1400 equal to 15 of earned income above 2500.

Here are some important facts about the Child Tax Credit. It is also refundable that is it can reduce your tax bill to zero and. The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever. Only one household can get Child Tax Credit for each child. Parents in 2021 got a financial boost from the American Rescue Plan which expanded the child tax credit and gave families monthly checks. Couples earning as much as 150000 a.

Source: cbpp.org

Source: cbpp.org

The taxpayers qualifying child must have a Social Security number issued by the Social Security Administration before the due date. You dont need to be working to get Child Tax Credit. 150000 if married and filing a joint return or if filing as a qualifying widow or widower. If your tax is 0 and your. The monthly Child Tax Credit payments of up to 300 for children under six and up to 250 for children ages six to 17 began going out in July and were sent every month through December.

Source:

Source:

More Information 3000 per child 6-17 years old. The credit is often related to the. The child tax credit can reduce your tax bill on a dollar-for-dollar basis. Joe Manchin is in the spotlight for holding up key parts of the Democratic agenda. While the 500 credit for older dependents is nonrefundable up to 1400 of the 2000 child tax credit can be refunded.

Source: cnbc.com

Source: cnbc.com

If your tax is 0 and your. Child Tax Credit does not include any help with the costs of childcare. Here are some important facts about the Child Tax Credit. Joe Manchin is in the spotlight for holding up key parts of the Democratic agenda. For 2021 the credit is fully refundable and depending on taxpayer.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Some families opted out of receiving the monthly payments in favor or receiving one lump sum or because they were worried about owing money on their taxes. Here are some important facts about the Child Tax Credit. 150000 if married and filing a joint return or if filing as a qualifying widow or widower. Similarly in the United Kingdom the tax credit is. What Is the Kiddie Tax Rule.

Source: cbsnews.com

Source: cbsnews.com

The monthly Child Tax Credit payments of up to 300 for children under six and up to 250 for children ages six to 17 began going out in July and were sent every month through December. More Information 3000 per child 6-17 years old. Kiddie Tax Kiddie Tax is the term used for the tax on certain unearned income of children taxed at the parents rate instead of the childs rate. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. A tax credit reduces the amount of taxes owed dollar for dollar.

Source: ally.com

Source: ally.com

In addition the credit was increased up to 3600 per year for children ages 5 and under at the end of this year. The child tax credit is a very popular topic these days so I thought I would provide some details to help explain the tax credit to the general public. 112500 if filing as head of household. What Is the Child Tax Credit. Half of the annual credit amount is being paid out in.

Source: reuters.com

Source: reuters.com

IRS Tax Tip 2020-28 March 2 2020 Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17. Child Tax Credit does not include any help with the costs of childcare. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. The foreign equivalents of UK tax-free benefits. A child tax credit is a tax credit for parents with dependent children given by various countries.

Source: milestonefinancialplanning.com

Source: milestonefinancialplanning.com

Only one household can get Child Tax Credit for each child. Child Tax Credit is paid to help people with the costs of bringing up a child. The program provides the tax credit to all parents with children including those who are not required to file a federal tax return. What Is the Kiddie Tax Rule. But experts say hes.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

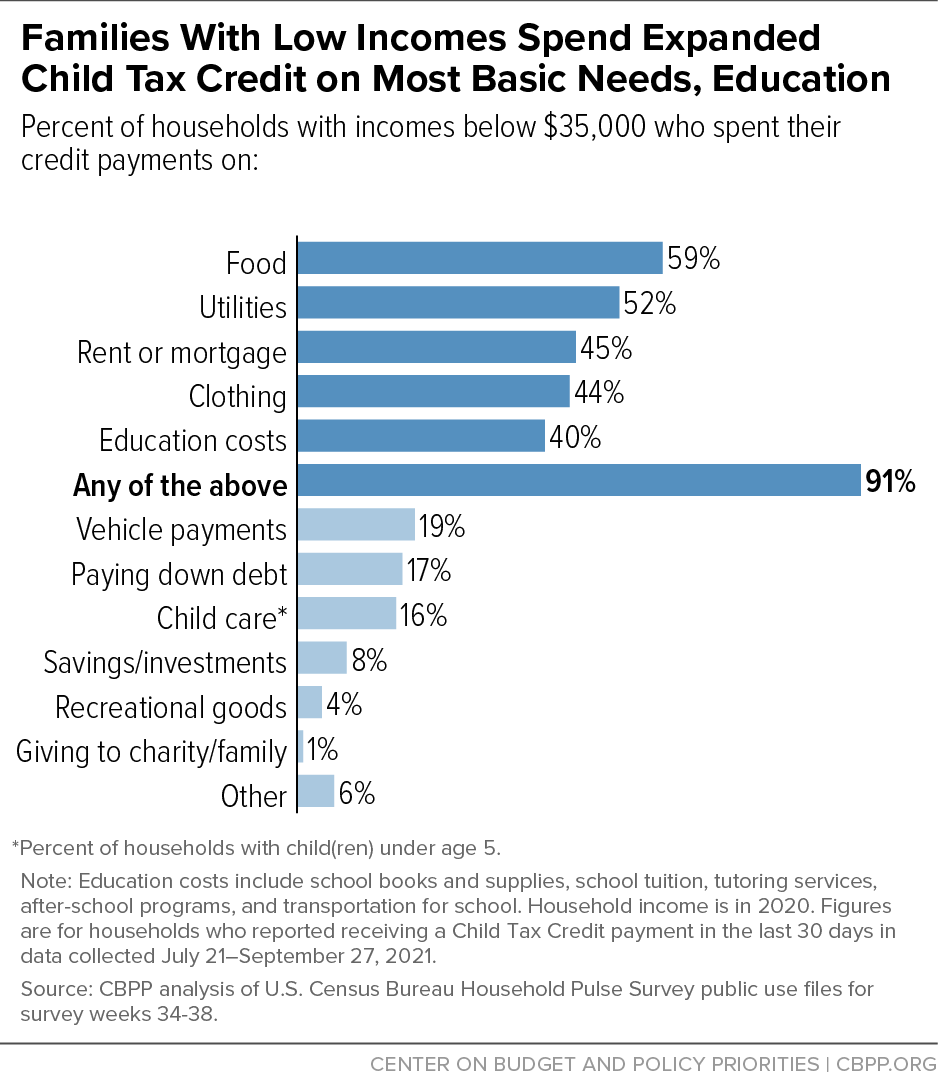

Its reducing child poverty and food insufficiency. Child Tax Credit does not include any help with the costs of childcare. Parents in 2021 got a financial boost from the American Rescue Plan which expanded the child tax credit and gave families monthly checks. What Is the Child Tax Credit. But experts say hes.

Source: cbpp.org

Source: cbpp.org

But experts say hes. Children typically are in a lower tax bracket than their parents and the Kiddie Tax was developed to prevent parents from lowering their tax liability by shifting investment. What is the child tax credit is the first question. For 2021 the credit is fully refundable and depending on taxpayer. Its reducing child poverty and food insufficiency.

Source: cbpp.org

Source: cbpp.org

The child tax credit is a very popular topic these days so I thought I would provide some details to help explain the tax credit to the general public. If your tax is 0 and your. For 2021 the credit is fully refundable and depending on taxpayer. And up to 3000 a year for those ages 6 to 17 on a sliding scale based on income. The foreign equivalents of UK tax-free benefits.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. You dont need to be working to get Child Tax Credit. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. The program provides the tax credit to all parents with children including those who are not required to file a federal tax return. What Is the Child Tax Credit.

Source: the-sun.com

Source: the-sun.com

And up to 3000 a year for those ages 6 to 17 on a sliding scale based on income. In addition the credit was increased up to 3600 per year for children ages 5 and under at the end of this year. Hes reiterating demands to impose a work requirement on the expanded child tax credit. While the 500 credit for older dependents is nonrefundable up to 1400 of the 2000 child tax credit can be refunded. The monthly Child Tax Credit payments of up to 300 for children under six and up to 250 for children ages six to 17 began going out in July and were sent every month through December.

Source: itep.org

Source: itep.org

The fact that most families are using some of their tax credits to pay for food and other essentials isnt surprising says Elaine Maag a researcher at the Urban Institute. But the expanded tax credit doesnt just go to the poor. The American Rescue Plan increased the CTC for 2021 only to help. Only one household can get Child Tax Credit for each child. IRS Tax Tip 2020-28 March 2 2020 Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17.

Couples earning as much as 150000 a. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. 112500 if filing as head of household. But experts say hes. The American Rescue Plan which President Joe Biden signed into law in March enhanced the Child Tax Credit in several ways.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is child tax credits used for by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.