Your Gift to brother in law income tax images are available. Gift to brother in law income tax are a topic that is being searched for and liked by netizens now. You can Get the Gift to brother in law income tax files here. Find and Download all free vectors.

If you’re looking for gift to brother in law income tax pictures information related to the gift to brother in law income tax topic, you have visit the ideal blog. Our website frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

Gift To Brother In Law Income Tax. So the gift of 5 lakh received from your brother is not income at all and therefore you are not required to disclose it in your income tax return. You may receive gifts and inheritances up to a set value over your lifetime before having to pay CAT. If giving of gift is taxable as per US income tax laws may be ascertained from concerned authorities. So the gift from son in law is tax-free.

Income Tax On Gifts Know When Your Gift Is Tax Free Businesstoday From businesstoday.in

Income Tax On Gifts Know When Your Gift Is Tax Free Businesstoday From businesstoday.in

The gifts that you receive both in terms of money or in other forms are exempted from tax if their total amount in a given financial year is less than Rs 50000. For more information on previous rates see CAT Thresholds Rates and Rules. Yes brother can gift any amount of money to sister without any tax implications as its exempt from tax. The person who gives you the gift or inheritance is. Mr Deepak Kumar your point is true for non-relatives from my understanding. 50000 in a year from anybody other than your relatives please remember there is a tax on that gift.

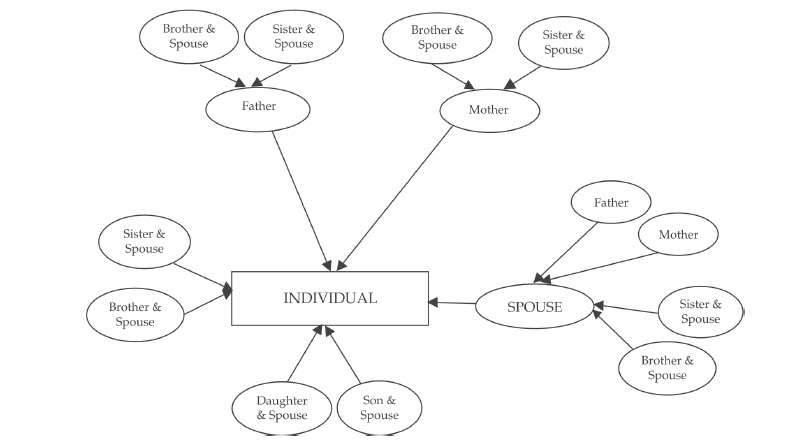

Brother in Law his Wife Mth B th INDIVIDUAL Sister in Law Mothers Sister Her Her Husband Mothers Brother his WifeMama Mami From whom GIFT Can be taken Spouse Brother His Wife HusbandMasi Masa Sister her Husband Son his Wife Daughter her Husband Relatives Gift Us 562v of the Income Tax Act 1961Relatives Gift Us 562v.

According to the IT Act following persons would be considered as relative –spouse brother or. For more information on previous rates see CAT Thresholds Rates and Rules. The gift is not taxable in the hands of brothers wifeas she is a relative as defined in Sec 562-. Any lineal ascendant or descendant of the individual. So the gift from son in law is tax-free. SO IN THAT CASE WILL THIS GIFT CAN BE TREATED AS TAX FREE GIFT OR SHE HAS TO PAY TAX ON THESE RECEIPTS.

Source: taxguru.in

Source: taxguru.in

Instead of relative as provided by the statute blood relative has been considered by the Learned AO and as a result whereof addition was made which is absolutely erroneous as rightly pointed out by the. Will not attract any income tax. Moreover its free from income tax as per prevailing Indian law present in force. Brother in Law his Wife Mth B th INDIVIDUAL Sister in Law Mothers Sister Her Her Husband Mothers Brother his WifeMama Mami From whom GIFT Can be taken Spouse Brother His Wife HusbandMasi Masa Sister her Husband Son his Wife Daughter her Husband Relatives Gift Us 562v of the Income Tax Act 1961Relatives Gift Us 562v. According to the IT Act following persons would be considered as relative –spouse brother or.

Source: mymoneysage.in

Source: mymoneysage.in

1 Like Vijaykumar Chandrasekaran 24 Points Replied 20 August 2021 All thanks for confirming on relation context. By virtue of Section 56 of the Income Tax Act. CAT is a tax on gifts and inheritances. Moreover its free from income tax as per prevailing Indian law present in force. 231k 1 1 gold badge 50 50 silver badges 83.

Source: businesstoday.in

Source: businesstoday.in

Will not attract any income tax. 2 lakh can be subject to penalty us 269ST with effect from 1st April 2017 irrespective of the fact that the gift has been received from family member. Gifts from others. CAT is a tax on gifts and inheritances. Any inheritance your brother receives will be completely tax-free although he may owe taxes on the future appreciation of any assets you leave him.

Source: taxguru.in

Source: taxguru.in

Would the law see this as a gift tax free or would they see it as us trying to avoid income tax that we would have to pay if for example we decided to pay my brother in rental income from my house instead. There are debates on treating them as lineal ascendants. Any lineal ascendant or descendant of the individual. Yes brother can gift any amount of money to sister without any tax implications as its exempt from tax. The term relative includes a spouse brother sister brother or sister of spouse brother or sister of either of the parents any lineal ascendant or descendant of the individual or of the spouse and spouse of any of the persons mentioned above.

Source: taxguru.in

Source: taxguru.in

Avoid gifts from mothers fathermother NanaNani as these are not tax free. Spouse of the person referred to in above points. Any inheritance your brother receives will be completely tax-free although he may owe taxes on the future appreciation of any assets you leave him. For more information on previous rates see CAT Thresholds Rates and Rules. Son in law is relative as per clause 5 with 7.

Source: relakhs.com

Source: relakhs.com

Gifts in the form of cash cheque items or property to a Resident Indian who is a relative both giver and receiver are exempt from tax in India. Gifts received from relatives are exempt from tax. Gifts from others. 231k 1 1 gold badge 50 50 silver badges 83. You may receive gifts and inheritances up to a set value over your lifetime before having to pay CAT.

Source: paisabazaar.com

Source: paisabazaar.com

Gifts in the form of cash cheque items or property within Rs. 1 Like Vijaykumar Chandrasekaran 24 Points Replied 20 August 2021 All thanks for confirming on relation context. The Gift Tax was introduced in India in 1958 but gift tax in India is now coming under the Income Tax Act. Gifts received From Relatives As per the Income tax act the sum of money received from any of your relatives are fully exempt from tax. Gifts in the form of cash cheque items or property to a Resident Indian who is a relative both giver and receiver are exempt from tax in India.

Source: basunivesh.com

Source: basunivesh.com

Though legally no gift deed is required to be. According to the IT Act following persons would be considered as relative –spouse brother or. Instead of relative as provided by the statute blood relative has been considered by the Learned AO and as a result whereof addition was made which is absolutely erroneous as rightly pointed out by the. If giving of gift is taxable as per US income tax laws may be ascertained from concerned authorities. So the gift of 5 lakh received from your brother is not income at all and therefore you are not required to disclose it in your income tax return.

Source: taxreturnwala.com

Source: taxreturnwala.com

For more information on previous rates see CAT Thresholds Rates and Rules. Mr Deepak Kumar your point is true for non-relatives from my understanding. CAT is a tax on gifts and inheritances. Leave a reply Your are not logged in. 50000 to a Resident Indian who is a not a relative both giver and receiver are exempt from tax in India.

Source: bcasonline.org

Source: bcasonline.org

Spouse of the person referred to in above points. THANKS IN ADVANCE FOR YOUR EXPERT ADVICE. Follow edited Feb 6 18 at 1139. United-kingdom tax-law real-estate gift. Though legally no gift deed is required to be.

Source: relakhs.com

Source: relakhs.com

According to the IT Act following persons would be considered as relative –spouse brother or. Other gifts which are taxable should be shown under income from other source and necessary income tax has to be paid based on income tax slab. The term relative includes a spouse brother sister brother or sister of spouse brother or sister of either of the parents any lineal ascendant or descendant of the individual or of the spouse and spouse of any of the persons mentioned above. Hence gift from father mother brother sister father-in-law mother-in-law brother-in-law sister-in-law etc. CAT is a tax on gifts and inheritances.

Source: blog.taxbuddy.com

Source: blog.taxbuddy.com

Here the relatives term defines by the Income Tax act as follows. THANKS IN ADVANCE FOR YOUR EXPERT ADVICE. Any lineal ascendant or descendant of the spouse of the individual. Further that whether the gift so received by the assessee from his brotherinlaw is exempted from tax under section 56 of the Act has been considered on a wrong notion. The gifts that you receive both in terms of money or in other forms are exempted from tax if their total amount in a given financial year is less than Rs 50000.

Source: caclubindia.com

Source: caclubindia.com

PLEASE ALSO ADVICE THE TAX LIABILITIES ON MOTHER IN LAW BROTHER IN LAW ON GIVING THIS GIFT CHEQUE TO HER. Will not attract any income tax. Grand parents can give tax free gifts. PLEASE ALSO ADVICE THE TAX LIABILITIES ON MOTHER IN LAW BROTHER IN LAW ON GIVING THIS GIFT CHEQUE TO HER. 50000 in a year from anybody other than your relatives please remember there is a tax on that gift.

Source: taxguru.in

Source: taxguru.in

THANKS IN ADVANCE FOR YOUR EXPERT ADVICE. Though legally no gift deed is required to be. So if you are receiving more than Rs. 231k 1 1 gold badge 50 50 silver badges 83. Brother or sister of either of the parents of the individual.

Source: businesstoday.in

Source: businesstoday.in

Brother in Law his Wife Mth B th INDIVIDUAL Sister in Law Mothers Sister Her Her Husband Mothers Brother his WifeMama Mami From whom GIFT Can be taken Spouse Brother His Wife HusbandMasi Masa Sister her Husband Son his Wife Daughter her Husband Relatives Gift Us 562v of the Income Tax Act 1961Relatives Gift Us 562v. United-kingdom tax-law real-estate gift. Son in law is relative as per clause 5 with 7. Brother in Law his Wife Mth B th INDIVIDUAL Sister in Law Mothers Sister Her Her Husband Mothers Brother his WifeMama Mami From whom GIFT Can be taken Spouse Brother His Wife HusbandMasi Masa Sister her Husband Son his Wife Daughter her Husband Relatives Gift Us 562v of the Income Tax Act 1961Relatives Gift Us 562v. 50000 in a year from anybody other than your relatives please remember there is a tax on that gift.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title gift to brother in law income tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.