Your Child tax credit payments for college students images are ready. Child tax credit payments for college students are a topic that is being searched for and liked by netizens today. You can Find and Download the Child tax credit payments for college students files here. Find and Download all royalty-free photos.

If you’re looking for child tax credit payments for college students images information linked to the child tax credit payments for college students interest, you have pay a visit to the right blog. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

Child Tax Credit Payments For College Students. FAMILIES with college students may qualify for a 500 single payment under Joe Bidens child tax credit extension. How much is the child tax credit for college students. For example if you have two children who are both in college you could receive up to an extra 1000 in child tax credit benefit. That means even low-income parents are eligible to receive the entire credit.

Child Tax Credit Schedule 8812 H R Block From hrblock.com

Child Tax Credit Schedule 8812 H R Block From hrblock.com

The exclusion called the Gift Tax Education Exclusion for Tuition means that money gifted to a friend or family member to pay for college tuition is not subject. The amount of the Child Tax Credit is based on the age of your dependent children. If you have a dependent whos a full-time college student and turns 25 this year you wont receive any payment for that dependent. However families with children who are 18 or full-time college students aged 19-24 whose parents or legal guardians claimed them as dependents will receive a one-time tax credit of 500 in April. For example if you have two children who are both in college you could receive up to an extra 1000 in child tax credit benefit. The Child Tax Credit will provide a one-time payment of up to 500 for 18-year-olds and those aged 19-24 who are full-time college students.

For example if you have two children who are both in.

These payments will be issued as part of your 2021 tax return. Parents with a child or children they claim as dependents who are in the first four years of their undergraduate education may qualify for the American Opportunity Tax. In addition eighteen-year-olds and full-time college students who are twenty-four and under can give parents a one-time 500 payment. Its sometimes referred to as the college tuition tax credit because its often taken to offset the costs of college tuition. The amount of the child tax credit increased from 2000 to 3600 for children under age 6 and 3000 for other children under age 18. The exclusion called the Gift Tax Education Exclusion for Tuition means that money gifted to a friend or family member to pay for college tuition is not subject.

Source: taxslayer.com

Source: taxslayer.com

The AOTC allows parents and students who arent considered dependents to reduce their tax bill by up to 2500 for up to four years. There are two additional tax breaks that students in college or their parents and guardians might benefit from. For students pursuing a degree or other recognized education credential. According to The American Rescue Act The Child Tax Credit will provide a one-time payment of up to 500 for 18-year-olds and those aged 19-24 who are full-time college students. FAMILIES with college students may qualify for a 500 single payment under Joe Bidens child tax credit extension.

Source: cnet.com

Source: cnet.com

It allows a maximum student tax credit of up to 2500 per student of these costs. FAMILIES with college students may qualify for a 500 single payment under Joe Bidens child tax credit extension. If you have a dependent whos a full-time college student and turns 25 this year you wont receive any payment for that dependent. If you have 18-year-old dependents they can qualify for up to 500 each toward the child tax credit amount youll receive. The IRS has made a one-time payment of 500 for a dependent age 18 or full-time college student up through age 24.

Source: cbpp.org

Source: cbpp.org

According to the IRS the maximum amount a parent can receive for the Credit for Other Dependents tax credit is 500 per dependent. However families with children who are 18 or full-time college students aged 19-24 whose parents or legal guardians claimed them as dependents will receive a one-time tax credit of 500 in April. This means if the credit brings the amount of tax owed to zero 40 percent of any remaining amount. The exclusion called the Gift Tax Education Exclusion for Tuition means that money gifted to a friend or family member to pay for college tuition is not subject. That means even low-income parents are eligible to receive the entire credit.

Source: the-sun.com

Source: the-sun.com

A special tax-code exemption allows a grandparent to pay college tuition and not have that money subjected to gift tax. The exclusion called the Gift Tax Education Exclusion for Tuition means that money gifted to a friend or family member to pay for college tuition is not subject. If you have 18-year-old dependents they can qualify for up to 500 each toward the child tax credit amount youll receive. For students pursuing a degree or other recognized education credential. Its sometimes referred to as the college tuition tax credit because its often taken to offset the costs of college tuition.

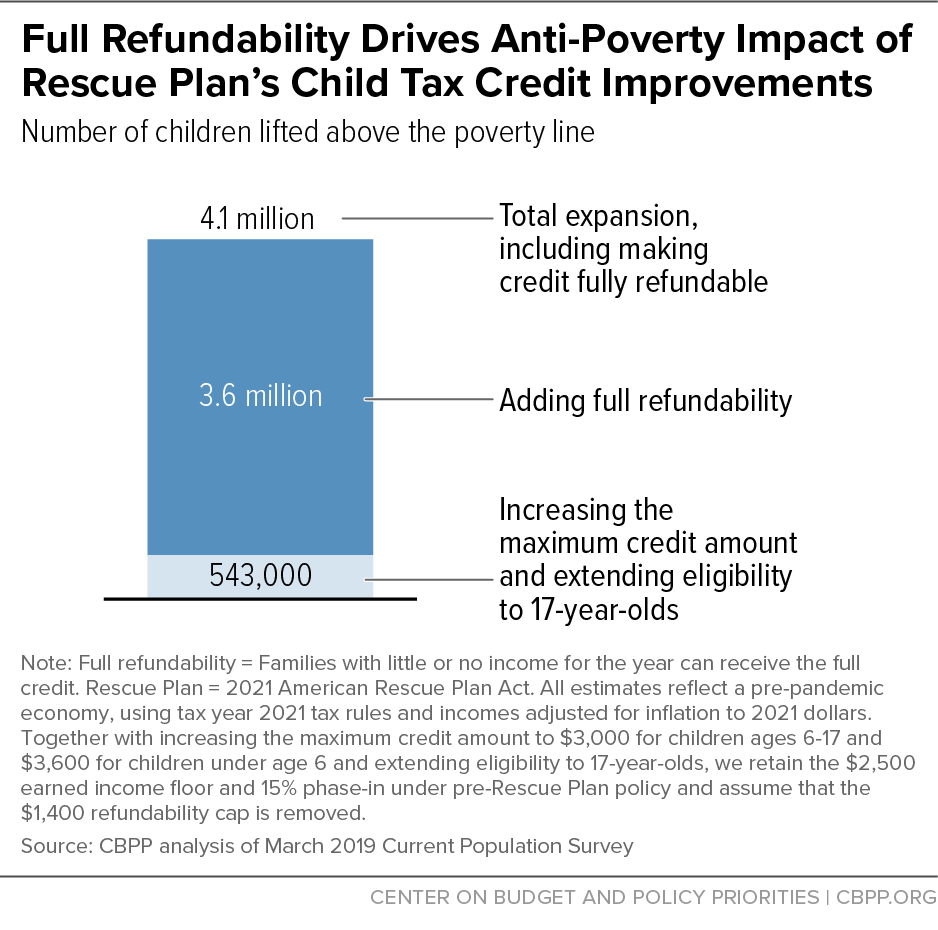

Source: cbpp.org

Source: cbpp.org

For example if you have two children who are both in college you could receive up to an extra 1000 in child tax credit benefit. If you have a dependent whos a full-time college student and turns 25 this year you wont receive any payment for that dependent. The child tax credit payments are available to those taxpayers with a modified adjusted gross income AGI of. Only for the first four years at an eligible college or vocational school. The American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC.

Source: cnbc.com

Source: cnbc.com

If you have a dependent whos a full-time college student and turns 25 this year you wont receive any payment for that dependent. The credits are now fully refundable. Heres what to know about dependent qualifications for the child. For example if you have two children who are both in college you could receive up to an extra 1000 in child tax credit benefit. The American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC.

Source: the-sun.com

Source: the-sun.com

The one time check will be sent to those eligible with dependants up to the age of 24 and in full in time study able to qualify. The amount of the Child Tax Credit is based on the age of your dependent children. Most taxpayers will be eligible for advance payments of this credit in monthly installments. The credits are now fully refundable. Its sometimes referred to as the college tuition tax credit because its often taken to offset the costs of college tuition.

Source: cnet.com

Source: cnet.com

The exclusion called the Gift Tax Education Exclusion for Tuition means that money gifted to a friend or family member to pay for college tuition is not subject. Most taxpayers will be eligible for advance payments of this credit in monthly installments. Read our stimulus checks live blog for the latest updates on Covid-19 relief. Only for the first four years at an eligible college or vocational school. The amount of the child tax credit increased from 2000 to 3600 for children under age 6 and 3000 for other children under age 18.

Source: cnbc.com

Source: cnbc.com

A special tax-code exemption allows a grandparent to pay college tuition and not have that money subjected to gift tax. According to The American Rescue Act The Child Tax Credit will provide a one-time payment of up to 500 for 18-year-olds and those aged 19-24 who are full-time college students. The amount of the child tax credit increased from 2000 to 3600 for children under age 6 and 3000 for other children under age 18. Most taxpayers will be eligible for advance payments of this credit in monthly installments. The American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC.

Source: taxslayer.com

Source: taxslayer.com

The credits are now fully refundable. Parents with a child or children they claim as dependents who are in the first four years of their undergraduate education may qualify for the American Opportunity Tax. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Heres what to know about dependent qualifications for the child. Tuition Fees Course materials.

FAMILIES with college students may qualify for a 500 single payment under Joe Bidens child tax credit extension. For example if you have two children who are both in college you could receive up to an extra 1000 in child tax credit benefit. The Child Tax Credit will provide a one-time payment of up to 500 for 18-year-olds and those aged 19-24 who are full-time college students. The American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC. A special tax-code exemption allows a grandparent to pay college tuition and not have that money subjected to gift tax.

Source: cnet.com

Source: cnet.com

Tuition Fees Course materials. According to the IRS the maximum amount a parent can receive for the Credit for Other Dependents tax credit is 500 per dependent. If you have 18-year-old dependents they can qualify for up to 500 each toward the child tax credit amount youll receive. That means even low-income parents are eligible to receive the entire credit. For students pursuing a degree or other recognized education credential.

Source: cnet.com

Source: cnet.com

The child tax credit payments are available to those taxpayers with a modified adjusted gross income AGI of. Most taxpayers will be eligible for advance payments of this credit in monthly installments. How much is the child tax credit for college students. Heres what to know about dependent qualifications for the child. It allows a maximum student tax credit of up to 2500 per student of these costs.

Source: hrblock.com

Source: hrblock.com

A special tax-code exemption allows a grandparent to pay college tuition and not have that money subjected to gift tax. The Child Tax Credit will provide a one-time payment of up to 500 for 18-year-olds and those aged 19-24 who are full-time college students. To be eligible to receive DaDA funding in the 2021 to 2022 academic year students must be aged between 16 and 23 years old at the start of the academic year for a dance course and between 18. There are two additional tax breaks that students in college or their parents and guardians might benefit from. The AOTC allows parents and students who arent considered dependents to reduce their tax bill by up to 2500 for up to four years.

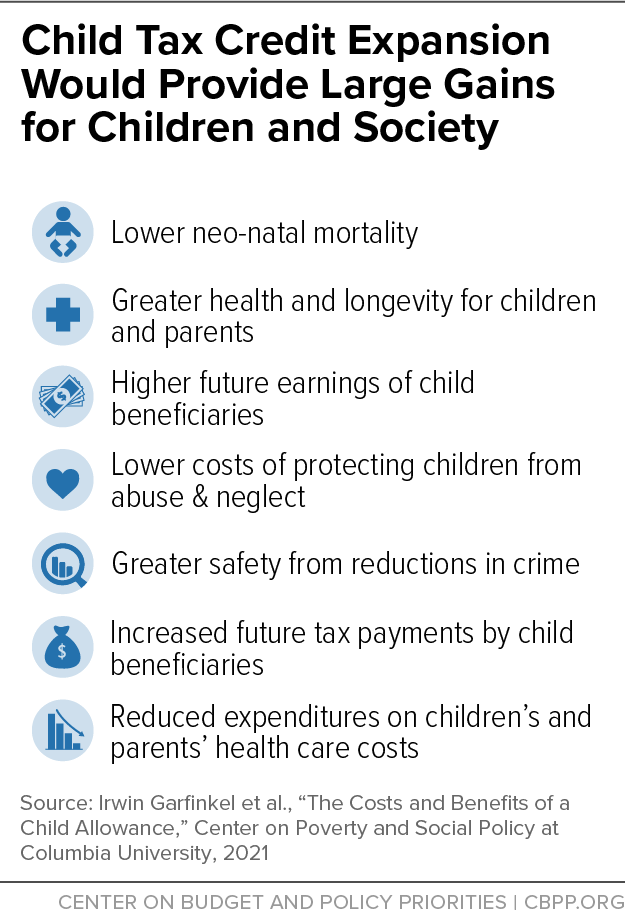

Source: cbpp.org

Source: cbpp.org

The one time check will be sent to those eligible with dependants up to the age of 24 and in full in time study able to qualify. Most taxpayers will be eligible for advance payments of this credit in monthly installments. Worth a maximum benefit up to 2500 per eligible student. For students pursuing a degree or other recognized education credential. It allows a maximum student tax credit of up to 2500 per student of these costs.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title child tax credit payments for college students by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.