Your Are taxes going up in 2021 images are available. Are taxes going up in 2021 are a topic that is being searched for and liked by netizens today. You can Find and Download the Are taxes going up in 2021 files here. Get all royalty-free photos and vectors.

If you’re looking for are taxes going up in 2021 images information linked to the are taxes going up in 2021 interest, you have visit the right blog. Our site always gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Are Taxes Going Up In 2021. If youre concerned about the possibility of tax rates going up or just looking to reduce your taxable income in 2021 consider these. Joint claimants will get 1252 extra with rates going up from 40393 to 41645 if theyre both under 25. Will you be paying more in taxes in 2021. In 2020 California collected 11 billion from cannabis companies and this year the.

Phần Mềm Thuế Tốt Nhất La Gi Turbotax Khối H R Dẫn đầu Goi Best Tax Software Tax Software Turbotax From pinterest.com

Phần Mềm Thuế Tốt Nhất La Gi Turbotax Khối H R Dẫn đầu Goi Best Tax Software Tax Software Turbotax From pinterest.com

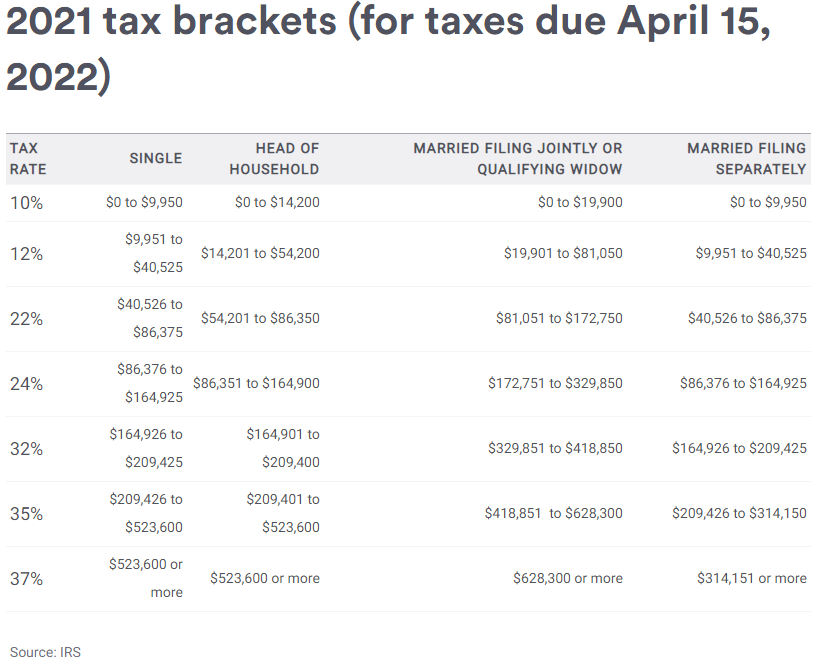

There is no personal exemption for 2021 as it was eliminated in the Tax Cuts and Jobs Act the overhaul of the tax code that took place in 2018. During its tax rate classification hearing on Dec. The Government has announced its 2021 Budget and with it an increase in Vehicle Excise Duty VED. 7 the Danvers Select Board voted to approve a commercial shift of 14220. Taxable income between 431900 to 647850 up from 418850 to 628300 for 2021 37. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

While couples over this age will get.

The tax law roughly doubled the threshold which was 549 million per person in 2017. Yes you can certainly expect to pay taxes in 2021 but you almost certainly wont see the same kind of tax return thanks to a number of. Joint claimants will get 1252 extra with rates going up from 40393 to 41645 if theyre both under 25. There is no personal exemption for 2021 as it was eliminated in the Tax Cuts and Jobs Act the overhaul of the tax code that took place in 2018. The tax law roughly doubled the threshold which was 549 million per person in 2017. What are the federal tax changes for 2020.

Source: pinterest.com

Source: pinterest.com

During its tax rate classification hearing on Dec. In 2020 California collected 11 billion from cannabis companies and this year the. What percentage of federal tax is withheld from my paycheck. The new rate would apply to income over 509300 for married couples filing jointly and 452700 unmarried individuals. A 125 percent rate of VAT will apply between October 1 2021 and March 31 2022 before reverting to the standard rate of 20 percent it is.

Source: pinterest.com

Source: pinterest.com

Theyll need to file a 2021 tax return even if they dont usually file to claim the credit. In 2020 California collected 11 billion from cannabis companies and this year the. Individuals will also need the amount of their third stimulus and any Plus-Up Payments received to. For those who are due a tax refund from the Internal Revenue Servi. Find out if taxes are going up and if so how much will you need to pay.

Source: pinterest.com

Source: pinterest.com

Alaska itself while still third highest for exporting of tax burdens has seen the When people all over the country vacation at Disney World or in Las Vegas. Some under-the-radar provisions in the TCJA could increase taxes While theres nothing in the TCJA that explicitly bumps up tax rates in 2021 there is another provision in the tax code that could. The tax law roughly doubled the threshold which was 549 million per person in 2017. In 2020 California collected 11 billion from cannabis companies and this year the. The new rate would apply to income over 509300 for married couples filing jointly and 452700 unmarried individuals.

Source: pinterest.com

Source: pinterest.com

Taxable income up to 10275 up from 9950 for 2021 12. The main reason that taxes rose in 2020 and are likely to rise again in 2021 is the soaring housing market. Taxable income between 10275 to 41775 up from 9950 to 40525 for 2021 22. Taxable income between 431900 to 647850 up from 418850 to 628300 for 2021 37. 6 States Where Taxes Are Going Up In 2021.

Source: pinterest.com

Source: pinterest.com

If youre concerned about the possibility of tax rates going up or just looking to reduce your taxable income in 2021 consider these. March 18 2021 In this study we define a states tax burden as state and local taxes paid by a states residents divided by that states share of net national product. 0765 for a total of 11475. Will you be paying more in taxes in 2021. The tax law roughly doubled the threshold which was 549 million per person in 2017.

Source: make-it-in-germany.com

Source: make-it-in-germany.com

Joint claimants will get 1252 extra with rates going up from 40393 to 41645 if theyre both under 25. Individuals will also need the amount of their third stimulus and any Plus-Up Payments received to. Biden can be a hero by making the current tax cut permanent and. Taxable income over 647850 up from 628300 for 2021 For individual single taxpayers. The tax law roughly doubled the threshold which was 549 million per person in 2017.

Source: in.pinterest.com

Source: in.pinterest.com

Taxable income over 647850 up from 628300 for 2021 For individual single taxpayers. 6 States Where Taxes Are Going Up In 2021. If youre concerned about the possibility of tax rates going up or just looking to reduce your taxable income in 2021 consider these. Taxable income over 647850 up from 628300 for 2021 For individual single taxpayers. Yes you can certainly expect to pay taxes in 2021 but you almost certainly wont see the same kind of tax return thanks to a number of.

Source: pinterest.com

Source: pinterest.com

The new rate would apply to income over 509300 for married couples filing jointly and 452700 unmarried individuals. If youre concerned about the possibility of tax rates going up or just looking to reduce your taxable income in 2021 consider these. Individuals will also need the amount of their third stimulus and any Plus-Up Payments received to. The tax law roughly doubled the threshold which was 549 million per person in 2017. The 2021 Budget also confirms that the planned rise in fuel duty the tax you pay per-litre of fuel will be cancelled.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765. Individuals will also need the amount of their third stimulus and any Plus-Up Payments received to. In 2020 California collected 11 billion from cannabis companies and this year the. A 125 percent rate of VAT will apply between October 1 2021 and March 31 2022 before reverting to the standard rate of 20 percent it is. Taxable income between 431900 to 647850 up from 418850 to 628300 for 2021 37.

Source: pinterest.com

Source: pinterest.com

While couples over this age will get. While theres nothing in the TCJA that explicitly bumps up tax rates in 2021 there is another provision in the tax code that could cause some people to. For the employee above with 1500 in weekly pay the calculation is 1500 x 765. In 2020 California collected 11 billion from cannabis companies and this year the. What are the federal tax changes for 2020.

Source: pinterest.com

Source: pinterest.com

What are the federal tax changes for 2020. What percentage of federal tax is withheld from my paycheck. The amount which changes each year to account for inflation is 117 million a person and 234 million for. The main reason that taxes rose in 2020 and are likely to rise again in 2021 is the soaring housing market. Are federal taxes going up in 2021.

Source: pinterest.com

Source: pinterest.com

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Median home list prices shot up about 72 year over year in 2020 and are estimated to. Taxable income over 647850 up from 628300 for 2021 For individual single taxpayers. While couples over this age will get. What are the federal tax changes for 2020.

Source: tr.pinterest.com

Source: tr.pinterest.com

Individuals will also need the amount of their third stimulus and any Plus-Up Payments received to. Yes you can certainly expect to pay taxes in 2021 but you almost certainly wont see the same kind of tax return thanks to a number of. We are now into 2022 and this means that taxpayers in the USA can start filing their taxes for the 2021 tax year. What are the federal tax changes for 2020. For the employee above with 1500 in weekly pay the calculation is 1500 x 765.

Source: pinterest.com

Source: pinterest.com

The new rate would apply to income over 509300 for married couples filing jointly and 452700 unmarried individuals. Are federal taxes going up in 2021. Taxable income over 647850 up from 628300 for 2021 For individual single taxpayers. Find out if taxes are going up and if so how much will you need to pay. What are the federal tax changes for 2020.

Source: pinterest.com

Source: pinterest.com

The Government has announced its 2021 Budget and with it an increase in Vehicle Excise Duty VED. Will you be paying more in taxes in 2021. The Government has announced its 2021 Budget and with it an increase in Vehicle Excise Duty VED. March 18 2021 In this study we define a states tax burden as state and local taxes paid by a states residents divided by that states share of net national product. What are the federal tax changes for 2020.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title are taxes going up in 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.